On 20 September 2019, Government of India announced the biggest tax cuts (~0.7% of FY20 GDP or INR 1.45 tn in value terms) for corporates and rolled back most tax-related amendments made in the Union Budget 2019. This tax cut in the backdrop of challenges on fiscal deficit front and need for a massive boost for government expenditure speaks volumes about the appetite for bold reforms of Modi 2.0.

The Taxation Laws (Amendment) Ordinance, 2019 issued on 20 September 2019, slashed the corporate tax rates from 34.94% to 25.17% (inclusive of Surcharge and Cess) for all existing domestic companies; and 17.16% (inclusive of Surcharge and Cess) for domestic companies incorporated on or after 1 October 2019. Visit our resource section to know more about Taxation in India.

The measure is expected to improve corporate savings, attract private investment (both Domestic and Foreign Direct Investment), bolster the competitiveness of India as a manufacturing hub, and support domestic demand as tax benefits are passed on to the end-consumer.

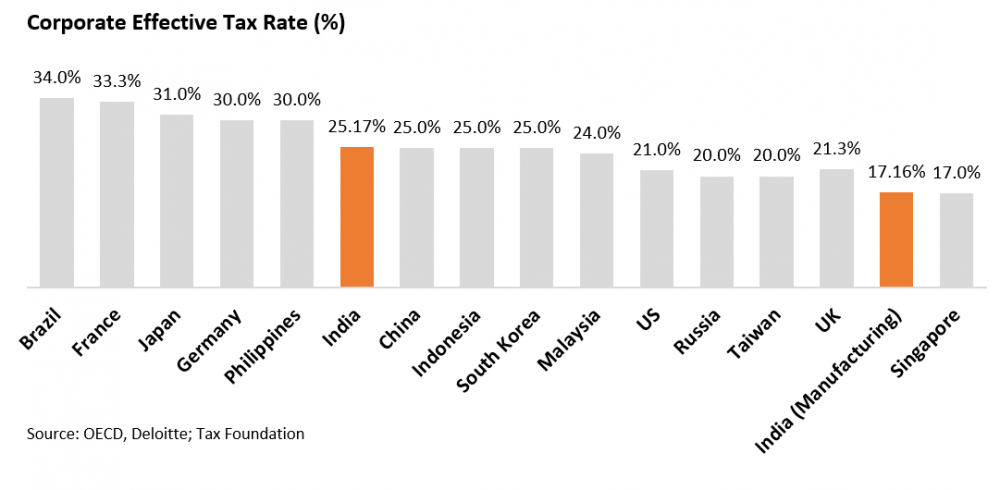

Corporate Income Tax Rates in India

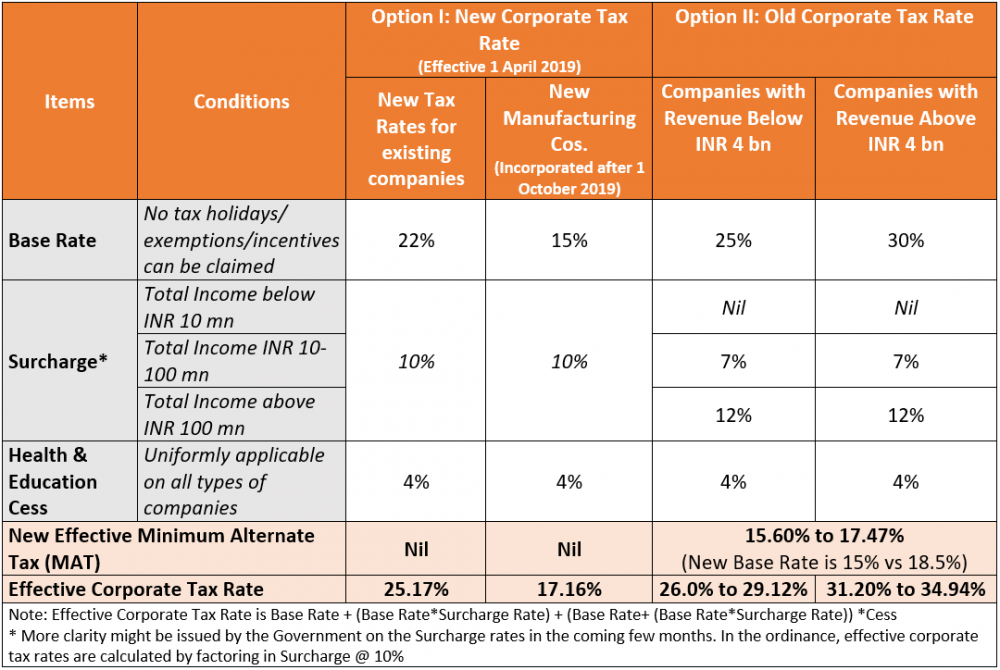

Government of India now allows corporates to choose between two tax rates highlighted in the table above as Option I and Option II. This step will help everybody transition to lower effective corporate taxation regime without any hiccups and will offer enough flexibility to avail old schemes.

Some of the highlights of the recent Direct Tax changes are:

Lower Tax Burden for Corporates: Corporate tax slashed for existing domestic corporates by ~10% (34.94% to 25.17%), inclusive of Surcharge and Cess

- Base Corporate Tax rate to be 22% (25.17% including Surcharge and Cess) for existing domestic companies without exemptions/tax holidays

- No Minimum Alternate Tax (MAT) applicable on such companies

Booster Shot for Make in India: Domestic companies incorporated after 1 October 2019 to pay a base rate of 15% (17.16% including Surcharge and Cess) provided they:

- Make fresh investments in manufacturing, related activities such as Distribution and R&D

- Commences operations by 31 March 2023

- Don’t set-up by splitting up, reconstruction, or by using old Plant & Machinery (Old imported machineries are allowed upto 20% of the total value), or by using old building used in past as a hotel or convention centre

- No Minimum Alternate Tax (MAT) applicable on such companies

Flexibility for Choosing New or Old Rates: Companies enjoying tax holidays/incentives resulting in effective corporate tax rates lower than 25.17% can continue to avail these benefits:

- Such companies will be benefitted by the reduced base rate of MAT at 15% (17.47% including Surcharge and Cess) vs 18.5% (21.55% including Surcharge and Cess) earlier. ~4.07% savings

- These companies can switch to concessional tax regime (i.e. 22% base rate) after the expiry of tax holiday/exemption period. The option once exercised cannot be subsequently withdrawn.

Likely Positive Impact — A Structural Shift in Indian Economy

Improvement in Corporate Profitability: As per data from CMIE, Corporate profitability in India has dipped from its peak of 7.4% of GDP in FY08 to 2.7% of GDP in FY19. The Corporate Tax Rate cut will arrest this fall and encourage fresh investments.

- For BSE 500, the effective tax rate in FY19 was 33.7% and it was 31.3% for Nifty 50. The new effective corporate tax rate at 25.17% will bring relief to domestic companies and foreign MNCs doing business in India.

- Improved corporate profitability will help achieve:

- Faster break-even for corporates

- Reduction in prices of products in some industries. E.g. FMCG

- Fresh capital expenditure, to tap both domestic and export demand

Enhancing India’s Competitiveness as a Manufacturing Destination: India is one of the most attractive markets for investments owing to large domestic market and fast-improving doing business environment. However, Global MNCs’ decisions are often driven by profitability and they are naturally biased to choose countries with lower tax rates and efficient value chains.

- The new corporate income tax rates in India will be lower than Brazil (34%), Germany (30%), and is like China (25%) and Korea (25%). New companies in India with an effective tax rate of 17.16%% is equivalent to what corporates pay in Singapore (17%).

- It is a well-known fact that global value chain has disrupted owing to the trade conflicts. Several countries in South East Asia have leveraged their lower Corporate Income Tax rates to attract foreign companies. With a 17.16% tax rate, India is well-placed to attract these companies with new vigour.