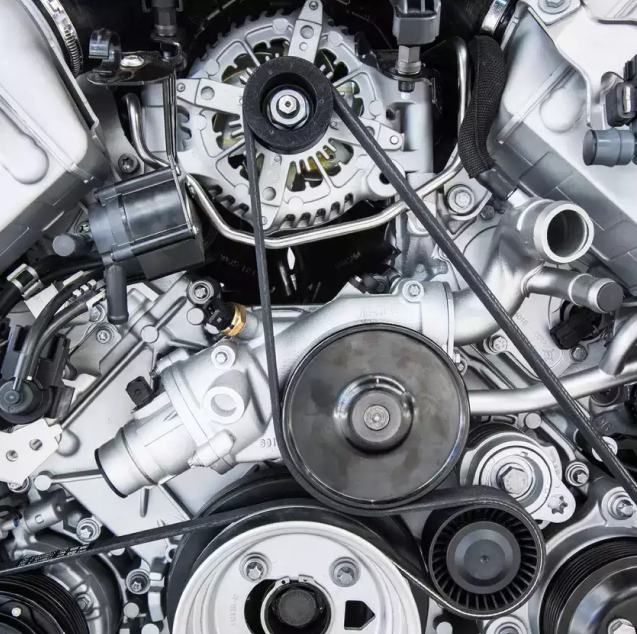

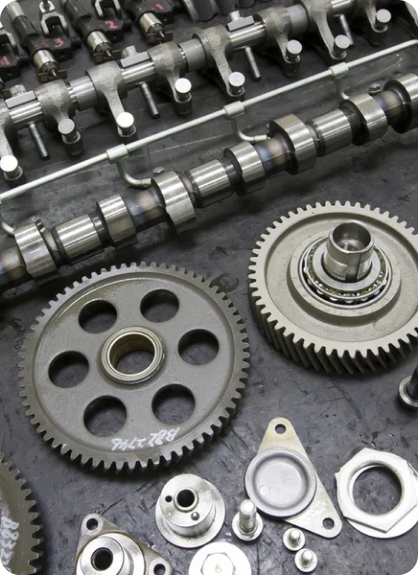

Why Invest in Auto Components

-

India’s Automobile Market

India is the world’s 3rd largest automotive market worth $151 Bn. It is the 4th largest manufacturer of passenger vehicles and the largest manufacturer of 2-wheelers and 3-wheelers globally.

-

Supportive Government Policies

PM E-DRIVE ($1.3 Bn), Scheme to promote the manufacturing of Electric Vehicles.

-

Export Potential

Government Grants on exports, Make in India initiative, proximity to the Gulf and ASEAN market (UAE, Malaysia, Indonesia, Sri Lanka, Africa).

-

Improved Infrastructure

India has about 63.73 Lakh km of road network, which is the second largest in the world.