The Covid-19 pandemic has had a major impact on the adoption and growth of digital payments across the globe. India demonstrates a robust digital payments landscape and has become a case study across several developed economies and major central banks. Amidst the Covid upheaval as well, the growth trajectory of India’s digital payments ecosystem has been exponential, with over INR 5 lakh crore UPI transactions in value just for the month of March 2021 alone.

In order to further boost the digital payments ecosystem in India, the Reserve Bank of India (“RBI”) released a framework in August 2020 for setting up pan-India umbrella entity/ entities focussing on retail payment systems, and invited applications for the same.

What are NUEs?

Under the RBI framework, New Umbrella Entities (“NUEs”) are entities that can operate in the retail payment space and can be set up as either for-profit companies or not-for-profit companies. The scope of activities that can be undertaken by these entities has been outlined by the RBI, some of which include:

- Setting up, managing, and operating new payment system(s) in the retail space comprising of but not limited to ATMs, White Label PoS, etc.

- Operating clearing and settlement systems for participating banks and non-banks.

- Monitoring retail payment system developments and related issues in India and internationally to avoid shocks, frauds and contagions.

- Offering innovative payment systems to include excluded cross-sections of the society.

- Developing payment systems that should be interoperable with the systems operated by NPCI, to the extent possible.

Why has the RBI come up with this framework?

Currently, the majority of the retail payment systems in India come under the aegis of the National Payments Corporation of India (NPCI), for example, the popular Unified Payments Interface or UPI, the Immediate Payment Service or IMPS, Bharat Bill Pay, Aadhaar-enabled Payment System, and RuPay are some of the retail payments operated by the NPCI. NPCI being the sole entity that facilitates retail payments in the country is at the risk of facing the burden of India’s burgeoning digital payments ecosystem, considering the volume of transactions and the number of new entrants.

Allowing new organizations to set up NUEs will not only offer fresh perspectives and insights by way of fostering innovation in the digital payment industry but will also effectively increase the competitive landscape in this industry. Further, this move by the RBI helps to address some of the key concerns raised by the industry players in the retail payments space in relation to the concentration risk and the resultant impact on economic efficiency and financial stability.

The NUE framework has been laid down by the RBI in line with its objective of financial inclusion, by developing payment system infrastructure(s) and offer more efficient and viable retail payment solutions to customers.

Who can set up NUEs?

Entities owned and controlled by resident Indian citizens with 3 years experience in the payments ecosystem as Payment System Operator (PSO) / Payment Service Provider (PSP) / Technology Service Provider (TSP) are eligible to be promoters of NUEs. Entities holding more than 25% in the NUE will be considered as ‘promoters’ and one promoter cannot hold more than 40% stake in a NUE. The promoters and the NUE must conform to the norms of corporate governance and ‘fit and proper’ criteria as specified by the RBI. Further, foreign investment is also permitted in the NUE, subject to the extant FEMA guidelines.

Structure of the NUE

The NUE can be incorporated as a for-profit or a not-for-profit company under the Companies Act, 2013 and will receive authorisation from the RBI under the Payment and Settlement Systems Act, 2007. The minimum paid-up capital for setting up of the NUE is INR 500 crore and the promoters will be required to shell out upfront capital contribution of 10% i.e., INR 50 crore at the time of making an application for setting up of the NUE. The balance capital is to be secured at the time of commencement of business operations. The promoters have the option to dilute their shareholding to a minimum of 25% after 5 years of the commencement of business. However, a minimum net worth of INR 300 crore is to be maintained by the NUE at all times. The NUE will be required to commence business operations within 6 months (extendable to 1 year) from the date of in-principle approval by the RBI

Participants so far

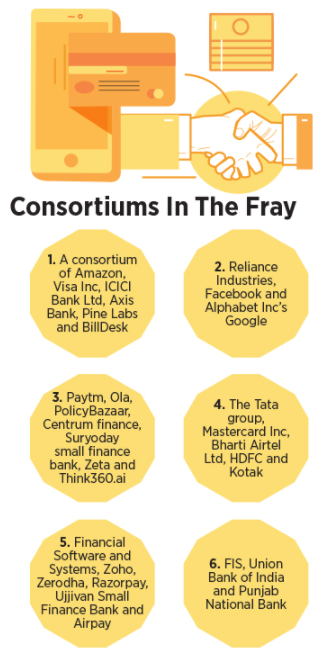

The deadline for submitting proposals for setting up NUEs to the RBI came to an end on 31 March 2021. Six consortiums comprising some of the leading market players in the digital payment space like Paytm, BillDesk, Visa, Mastercard, Razorpay, etc., global tech giants like Facebook, Amazon, Google, banks and financial institutions like Axis Bank, ICICI Bank, etc., and other leading industry players like Reliance Industries, Tata Group, etc. have submitted their proposals for setting up the umbrella entities rivaling the NPCI platform:

These proposals will be scrutinized by an External Advisory Committee, which will then submit its recommendations to the RBI. The RBI intends to complete this process within six months. As of now, the RBI has not indicated the number of in-principal approvals it plans on granting for setting up of NUEs.

A welcome change

Keeping in mind the current need of the hour – adoption and expansion of digital payments acceptance infrastructure, this step taken by the RBI can definitely be seen as an attempt to invigorate the digital payment ecosystem and carries the potential to revolutionize the Indian digital payments landscape.

This blog has been authored by Arshia Verma

Update: On December 3, 2021, Hon'ble Prime Minister Narendra Modi will inaugurate the Infinity Forum on fintech, which among other things will discuss and come up with actionable insights into how technology can be leveraged by the fintech industry for inclusive growth.

- https://www.businessinsider.in/finance/news/upi-crosses-5-lakh-crore-in-transaction-value-in-march/articleshow/81820799.cms

- https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11954&Mode=0

- https://www.forbesindia.com/article/take-one-big-story-of-the-day/from-tatas-and-airtel-to-reliance-and-google-how-new-partnerships-will-change-indias-digital-payments-ecosystem-forever/67337/1