On the 9th of March, the Government of India launched the second phase of the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME), valid till 2022. Through the incentive scheme, the Government has indicated the direction it wants India’s mobility electrification to take: penetration in the two-wheeler segment, commercial vehicles, and public transportation. While the rationale for a push among commercial vehicles and public transportation is to drive rapid electrification at a fleet and institutional level, the story of electrifying India’s two-wheeler market plays out at several levels.

Expanse of the Two-Wheeler Market

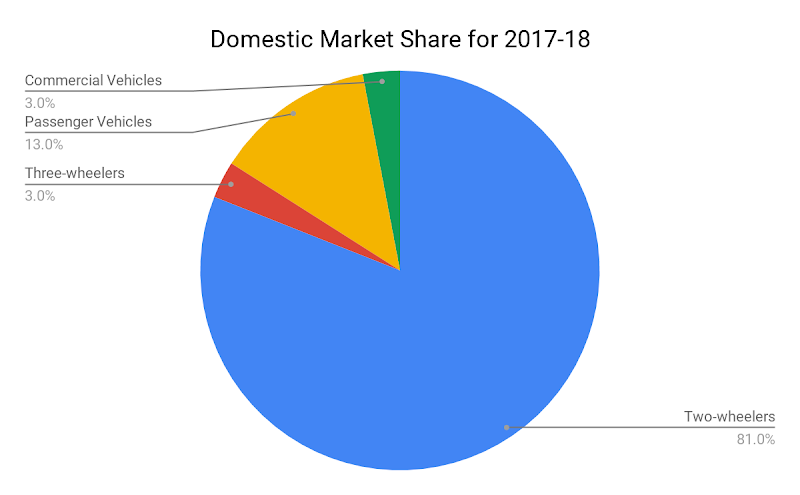

As a developing economy of 1.3 bn people, India’s need for accessible mobility is far higher than that of other nations. With increased urban and rural infrastructural development, urbanization, rising purchasing power and a need for increased connectivity, the two-wheeler segment in India has really blossomed and now comprises three-fourths of the nation’s total transportation fleet. For every 100 vehicles on Indian roads, 81 will be two-wheelers and only 16 will be four-wheelers.

Source - SIAM

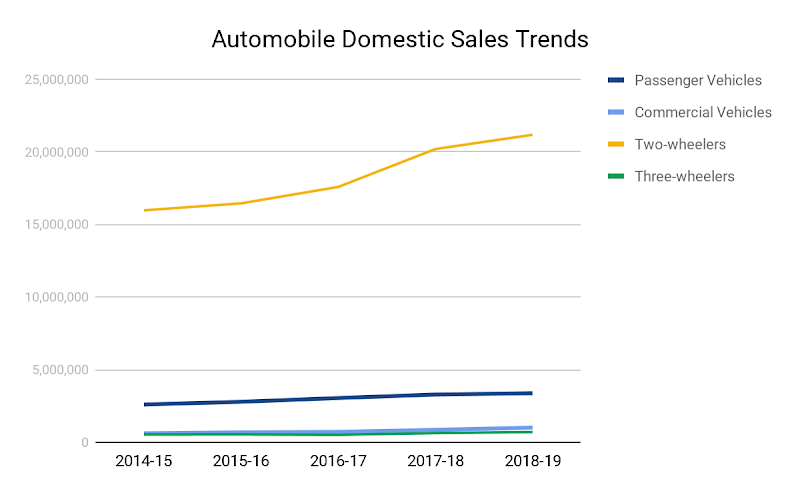

Not only do two-wheelers have a larger share as compared to other segments but they also enjoy a higher inclination and upward movement of growth. This can be seen in the below graph.

Source: SIAM

This adoption is especially deep-seated and can be seen nation-wide - urban centers as well as rural parts. On a city level comparison, there is a higher adoption of two-wheelers in Tier 1 cities which have well-established road networks. For example, in the case of Pune, for every 1000 passengers, there are 301 two-wheelers on the roads. This means with a population of 6.75 mn, there is a presence of 2 mn two-wheelers in Pune. Chennai and Bangalore are not far behind with 298 and 266 vehicles, respectively, for every 1000 passengers. However, in a segment comparison, rural households obviously have higher adoption of two-wheelers and bicycles as opposed to passenger vehicles.

With such a wide scale presence of two-wheelers in India, one would presume that the aforementioned factors contributing to its growth would also be causing the nation’s transition to more convenient modes, namely cars. However, this has not been the case. With close to one-third of total households dependent on two-wheelers for daily commute, India is now the largest two-wheeler market in the world, having surpassed even China. FY2018 saw the sale of over 20 mn two-wheelers in the nation, that’s 54,700 units daily. This number has provided a boost to the year-on-year growth of two-wheeler sales, which is expected to reach a two-digit figure (approximately 15.98%), a first since FY2012. Contributing to these numbers are the dozen major OEMs including Hero MotorCorp, TVS Motor Company, and Bajaj Auto among others. Further, the expanse of the market has made it very appealing for foreign players such as Yamaha Motors and Suzuki to enter and cater to not only the urban centers but also rural pockets.

With such a wide scale presence of two-wheelers in India, one would presume that the aforementioned factors contributing to its growth would also be causing the nation’s transition to more convenient modes, namely cars. However, this has not been the case. With close to one-third of total households dependent on two-wheelers for daily commute, India is now the largest two-wheeler market in the world, having surpassed even China. FY2018 saw the sale of over 20 mn two-wheelers in the nation, that’s 54,700 units daily. This number has provided a boost to the year-on-year growth of two-wheeler sales, which is expected to reach a two-digit figure (approximately 15.98%), a first since FY2012. Contributing to these numbers are the dozen major OEMs including Hero MotorCorp, TVS Motor Company, and Bajaj Auto among others. Further, the expanse of the market has made it very appealing for foreign players such as Yamaha Motors and Suzuki to enter and cater to not only the urban centers but also rural pockets.

Need for Change

It is no surprise that the Government has put the two-wheeler segment first on its target list. While the large market share makes it the preferred target segment, the heightened contribution to pollution makes it the first change needed. Unique to the two-wheeler segment - inherent advantages of its electric counterparts will act as primary catalysts for the evolution of the segment: Superior Cost of Economics

One of the primary concerns that wallet-conscious Indians have with electric vehicles is the heightened capital cost attached with electric alternates. A conventional petroleum two-wheeler has a low retail price of Rs. 30,000 - 40,000 seems far more affordable as compared to electric alternatives which can cost as much as INR 1,10,000. One of the reasons for the price is the high cost of lithium-ion batteries, which is about 30-50%, dependant on the battery capacity, of the manufacturing cost of an electric scooter. Although most e-two-wheelers have the battery storage of about 1-1.5 kWh, in order to achieve an extremely efficient 100 km range, the vehicle needs to have a 3 kWh battery - the cost of which will be INR 30,000 - 40,000.

Firstly, the Government has recognized this in FAME II and will now be awarding incentives by battery capacity as opposed to the proportion of retail price. The demand incentive is allotted at INR 10,000 per kWh, an amount which could partially recover the battery cost. Further, it will discourage manufacturers from limiting capacity a step that previously degraded the range, power, and efficiency of the electric vehicle. Secondly, with the forthcoming implementation of Bharat Standard VI (April 2020), a Government initiative to regulate emissions of air pollutants from motor vehicles, there is an expected increase in purchasing cost petrol of two-wheelers. Some pundits expect prices to rise up to INR 80,000, leaving a price difference of at most INR 30,000, an amount which can be equalized by applicable demand incentives.

In contrast to the initial purchasing cost, the operational or running cost of electric two-wheelers is far more palatable. A liter of petrol costs about INR 70 and the conventional scooter operates at about INR 70–100 per 100 km. For an electric two-wheeler, with an electricity price of around INR 3-6 per unit, it would cost about INR 10–30 per 100 km, which is significantly lower. Bloomberg New Energy Finance estimates that the total cost of owning and operating an electric two-wheeler in 2020 will be about INR 2 per km which is lower than petrol vehicles, standing at INR 7-10 per km.

In conclusion, with a stable number across the nation, the two-wheeler segment is at a stage where it is ready for sustainable and rapid transition. The segment’s contribution to pollution makes this transition not only preferred but also very much needed. It is a well-known fact that transitioning to electric will make India less fossil fuel-dependent and environmentally sound; the long term hope is also reduced pollution and purer breathing air. However, taking into account the long-term cost-efficiency of electric two-wheelers there is a stronger case to be made. In addition to savings at the micro-level, India could potentially and gradually save a billion dollars on imports of crude oil.

In this new phase of mass adoption, the government needs to prepare for bulk production. To achieve cost parity with petrol two-wheelers, most manufacturers of electric two-wheelers take on an increased cost of research and development because battery efficiency is a primary concern for most of them. As 30-50% of the manufacturing cost, batteries need to be clean and cheap. Therefore, beyond demand incentives, there also needs to be a push on the manufacturing and supply side. In order to dip into India’s well-established automotive supply chain for electric vehicle manufacturing, more emphasis needs to be placed on technological advancement.

- https://economictimes.indiatimes.com/industry/auto/cars-uvs/bharat-stage-vi-norms-know-how-they-will-impact-you/articleshow/66362907.cms

- https://economictimes.indiatimes.com/industry/auto/auto-news/focus-indias-electric-vehicle-goals-being-realised-on-two-wheels-not-four/articleshow/67522910.cms

- https://www.livemint.com/Auto/N3Ixh0Mv3eu2vWfzeiRw3N/India-runs-on-two-wheels-and-animal-carts-data-shows.html

- http://www.eeherald.com/section/news/onws201307110electric-bike.html

- https://theprint.in/opinion/two-wheelers-are-the-future-of-electric-vehicles-in-india/134518/

- http://www.autocarpro.in/Interview/-medium-speed-electric-wheelers-bring-majority-volumes-28288

- https://www.autocarpro.in/news-national/india-wheeler-industry-sells-20m-units-fiscal-28927

- https://www.thehindu.com/business/indias-electric-vehicle-success-story-will-ride-on-two-wheels/article26425094.ece

- https://www.weforum.org/agenda/2017/10/what-india-can-teach-the-world-about-sustainability/

- https://www.autocarpro.in/news-national/india-wheeler-industry-sells-20m-units-fiscal-28927