Introduction

The ongoing novel coronavirus outbreak has severely disrupted economic and social life across the world. Besides an ever-increasing human toll, the economic costs of the pandemic have also been immense. This has created widespread uncertainty about China’s future global role and trade practices. It has been supplemented by growing worries about the global economy, now in its worst recession since the Great Depression of 1929. It is in this context that this paper assumes significance as it examines the recent announcements by the Japanese government offering massive incentives to their companies to move out of China and argues why Japan should look towards India as the foremost destination for diversifying its supply chains away from China. As will be seen through the course of this paper, India offers several unique returns for Japanese companies to boost their presence and investments in the country in the post-COVID world.

COVID-19 Outbreak Deepens Economic Crisis in Japan

The economic stimulus package announced by the Japanese government comes in the background of worsening economic conditions even in the overheated Japanese labour market. The COVID-19 outbreak has brought Japanese manufacturing to a near halt, thereby threatening millions of jobs and pushing numerous businesses under crippling debts. According to a recent survey by Teikoku Databank, the ongoing crisis has pushed companies like cruise ships and Japanese inns to private tutoring schools and tourism under crippling debts, even running up to 1.2 bn Yen ($11 mn) in some cases. A further 63% of the companies have reported a negative impact on their businesses due to this pandemic.

Ever since the outbreak first began in Japan early January, the pandemic has wreaked havoc to the country’s manufacturing industry, leading to a deep slide and contraction in the sector, reaching at 44.8 in March as compared to an already low figure of 47.8 in February, as per data from the latest PMI survey. The sharp drop in the output was coupled with a substantial decline in new orders, making the situation much worse.

Understanding the Japanese Economic Package

The worsening economic crisis in Japan fuelled by supply shortages in Japanese factories was coupled with increasing frustration in Japan over the lack of transparency by China during the initial days of this outbreak. Consequently, a number of Japanese politicians and business elites have been critical of China’s apparent reckless approach in tackling the COVID-19 outbreak when it began and hiding the true extent of its spread.

What followed was a shutdown of factories in China, leading to a huge disruption to Japanese supply chains and a 50% drop in exports to Japan in the month of February. This led to growing calls within Japan to rethink their manufacturing dependence on China. Heeding to those calls, Prime Minister Shinzo Abe while chairing the meeting of the Council on Investments for the Future on 5 March announced his willingness to bring high value-added product manufacturing bases back to Japan. Signalling the first sign of government funded relocation of domestic businesses away from China, he said, “We should try to relocate high added value items to Japan.”

Soon after, this statement was transformed into government policy with his government announcing a record budget in April to help Japan’s fight against COVID-19. The biggest highlight of this budget is the $2.2 bn (240 bn Yen) economic package created for Japanese firms currently based in China to move their production units out of China, either back to Japan or to other countries. Of this, $2 bn (220 bn Yen) have been earmarked for Japanese firms to move back to Japan while another $200 mn (23.5 bn Yen) have been provided to help relocate companies away from China to other countries.

The relief economic package, amounting to a record $992 bn (108.2 tn Yen) and is estimated to be around 20% of Japan’s yearly economic output, is also a clear indication of the extent of the crisis and damage that the government is preparing for.

Impact on China-Japan Trade Relations

The implications of this package will be wide and far-reaching, both in terms of geopolitics as well as economics. Specifically, the decision to promote the relocation of Japanese companies away from China, its largest trading partner indicates a growing consensus in Japan to move its supply chains back to the country, or to other preferable countries such as Vietnam, Thailand and India.

Reasons Driving Companies Out of China

Even though this package has been announced in the backdrop of a global COVID-19 pandemic, however, it is important that this economic budget must not be analysed solely as a result of the COVID-19 crisis and needs to be put into perspective to grasp the larger picture driving the Sino-Japanese economic relations for a while now.

Enlisted below are some of the major reasons contributing to this economic fallout between the two neighbours:

US-China tariff war:

Before the pandemic struck, the trade relations between the countries were already struggling. One of the foremost reasons being the heated trade war happening between the United States and China, both huge trading partners for Japan.

Preference for diversification to other countries:

China has been rapidly losing its attractiveness among Japanese countries for a while now, an example of which can be seen from the fact that about 159 Japanese companies operating in China have relocated to comparable countries like Vietnam and Thailand. Such diversification and shifting of Japanese firms away from China is estimated to create a $ 730 Bn economic opportunity for developing geographies like ASEAN and India.

Rising labour costs:

Another reason for China losing its sheen among Japanese firms are the rising labour costs in China, estimated to have gone up by three times in the last four years, standing at $ 6.50 per labour hour currently as compared to a country like India where it is $ 5 per labour hour.

Administrative and legal procedures:

The export-oriented Japanese firms have been facing multiple issues around administrative and legal procedures in China- some face problems with protecting their IPR while others have to deal with a complex tax and legal system as well as other regulatory and enforcement risks.

Why India

As the world’s second most populous country and its largest democracy, India provides the perfect combination of a large, rapidly growing market economy with open and democratic social values. Indo-Japanese cultural and economic ties have roots going back centuries, of which trade was always an important pillar. In the current times, India has been the largest recipient of Japan’s Official Development Assistance (ODA) program which has played a key role in developing India’s infrastructure through affordable loans and grants. In the recent decades, India has consistently featured as one of the world’s fastest growing major economies with average growth rates around 7 per cent while Japan continues to be an economic powerhouse and the third largest economy in the world.

India-Japan Cooperation

Indo-Japanese cooperation covers a wide spectrum of activities and has seen consistently upward growth as this strategic partnership deepens. Since the establishment of diplomatic ties between the two countries, Japan has played a key role in promoting economic and industrial development in India through affordable loans, grants, technology sharing and programs like the ODA. Over the decades, the friendly ties between the two countries have manifested in numerous successes for both, be it the Delhi Metro or the setting up of Japanese Industrial Townships (JITs) having special incentive packages for companies to operate in.

The economic relationship between India and Japan has always been on a growth spree, with a major revamp taking place since 2014, when ‘Modinomics and Abenomics’ came together to boost Japanese presence in India through greater investments and incentives. The Delhi Metro project, conceived and executed through Japan’s ODA, is a shining example of what this dynamic relationship can achieve with the right synergies in place. It did not come as a surprise, then, that in 2015, the same year that Japanese Prime Minister Shinzo Abe visited India, the country decided to bring the Japanese ‘Bullet Train’ system in India and enhance connectivity in some of India’s biggest cities and accelerate India’s economic growth.

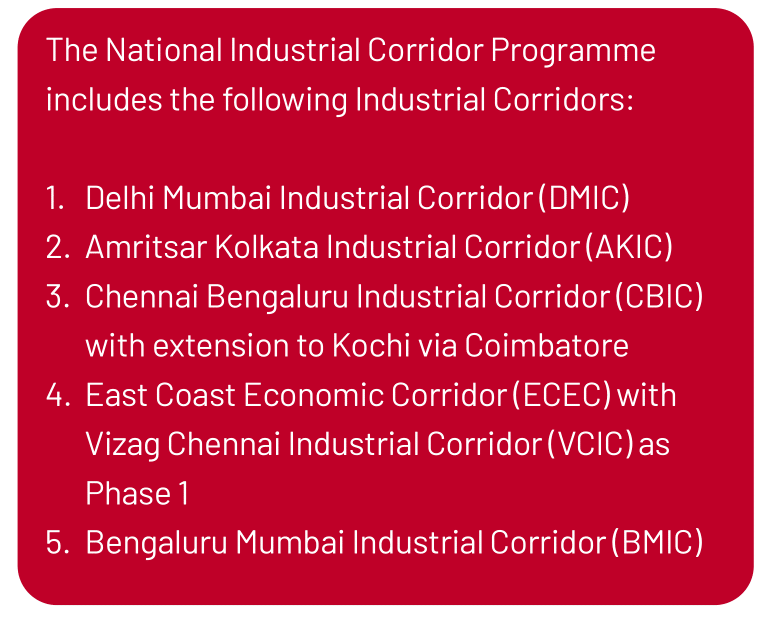

National Industrial Corridor Development Corporation Limited (NICDC)

One of the most prominent pillars of Indo-Japanese cooperation is Japan’s deep involvement in promoting connectivity and mobility in and around India. After the success of the Delhi Metro, both the countries decided to cooperate further to bring Japanese ‘Shinkansen’ trains and Industrial Corridors in India. The core objective of such cooperation was to expand India's manufacturing and services base and develop such National Industrial Corridors as a "Global Manufacturing and Trading Hub" based in India. This cooperation was further envisaged to provide a major impetus to planned urbanization in India with manufacturing as its key driver. Pursuant to this, the first in the series was the Delhi-Mumbai Industrial Corridor project, which was launched after a Memorandum of Understanding (MoU) was signed between the Governments of India and Japan in December 2006.

The Delhi Mumbai Industrial Corridor Development Corporation (DMICDC) Limited, a special purpose company, was incorporated to establish, promote and facilitate the development of the Delhi Mumbai Industrial Corridor (DMIC) project. Further, after the announcement of other Industrial Corridor projects by Govt. of India, the mandate of DMICDC has been expanded to INDIA-JAPAN COOPERATION NATIONAL INDUSTRIAL CORRIDOR DEVELOPMENT CORPORATION LIMITED (NICDC) develop and implement all Industrial Corridor projects in the country. National Industrial Corridor Development Programme is India's most ambitious infrastructure programme aiming to develop new industrial cities as "Smart Cities" and converging next-generation technologies across infrastructure sectors.

In addition to developing new industrial cities, the National Industrial Corridor Development Programme also aims to develop strong, resilient infrastructure linkages for India, like Greenfield Airports, high-capacity transportation and logistics facilities, Rail link projects etc.as well as softer interventions such as skill development initiatives to ensure upskilling of India’s local workforce engaged in these projects.

The NICDC is mandated to undertake project development activities for Investment Regions / Industrial Areas / Economic Regions / Industrial Nodes and Townships / Integrated Manufacturing Clusters / Stand Alone Projects / Early Bird Projects for various Industrial Corridor projects and assists various state governments. NICDC undertakes various project development activities like Preparation of Master Plans, Feasibility Reports and Detailed Project Reports and acts as an intermediary for the purpose of development and establishment of infrastructure projects through developing and disseminating appropriate financial instruments, negotiating loans and advances of all nature, and formulating schemes for mobilization of resources and extension of credit for infrastructure.

The NICDC has been registered as a company with 49 per cent equity of Government of India, 26 per cent equity of the Japan Bank for International Cooperation (JBIC) and the remaining held by Govt. of India owned financial institutions.

Besides assisting and investing in nationwide infrastructure projects like the DMIC and JITs, the Japanese government is also significantly invested in a range of regional and state-specific developmental projects in India. In this regard, it is important to note that Japan has either invested or is planning to invest in a host of projects in North-East India that include a water supply project in Guwahati, enhancing the road network in Assam-Meghalaya, various forest management and agriculture projects in other North-Eastern states, which crucially also serve as a gateway to Southeast Asia. In 2017, the Japan International Cooperation Agency (JICA) signed an agreement with India to provide $ 610 Mn for the Phase I of the North-East Road Network Connectivity Improvement Project, which will focus on projects in Meghalaya and Mizoram.

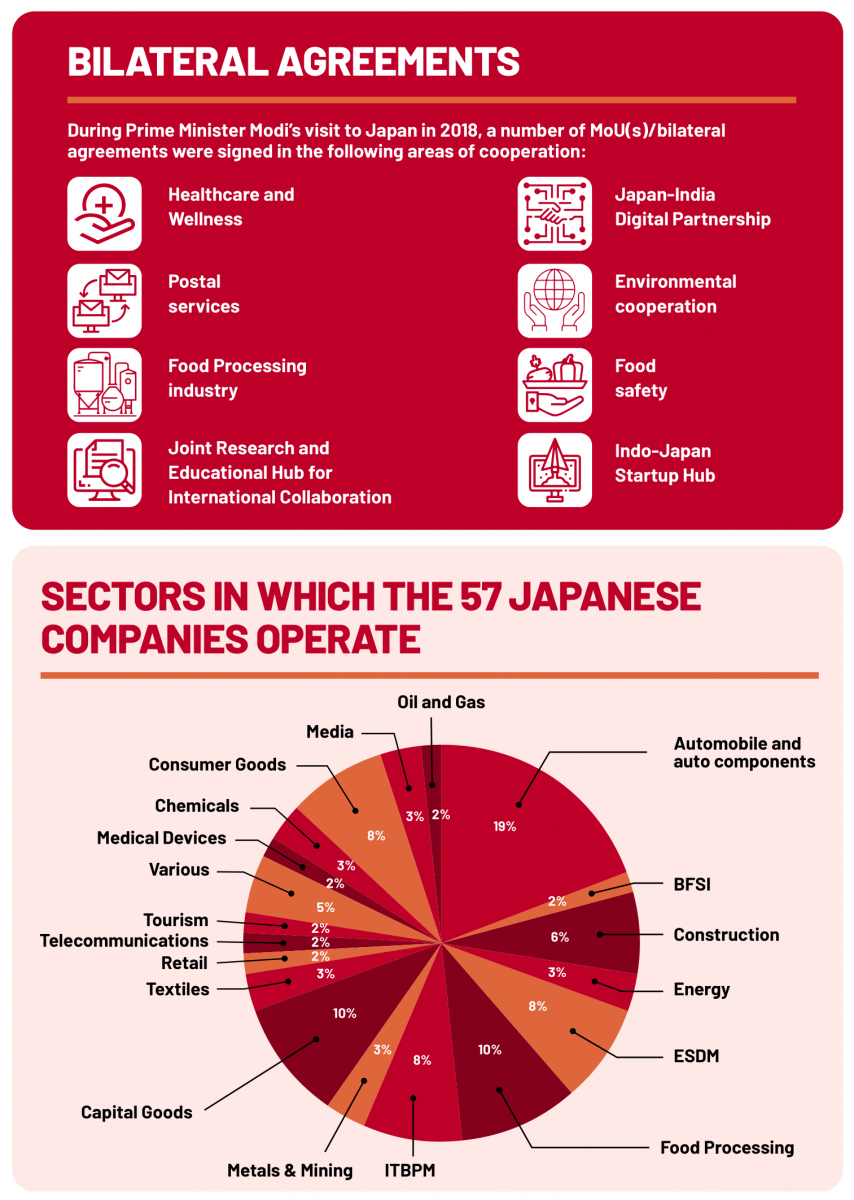

Furthermore, 57 Japanese companies also signed Letter of Intent and Acknowledgement to making greater investments in India during Prime Minister Modi’s Japan visit in 2018. These companies operate in a wide range of sectors such as automobiles and auto components, construction, textiles, food processing and energy among many others.

India-Japan Industrial Competitiveness Partnership (IJICP)

On December 10, 2019, Minister of Commerce and Industry, Government of India, Piyush Goyal and Minister of Economy, Trade and Industry (METI), Government of Japan, Hiroshi Kajiyama, decided to launch the India-Japan Industrial Competitiveness Partnership (IJICP).

This partnership proposes that the governments of India and Japan will jointly work toward enhancing India’s industrial competitiveness (through discussions in areas such as development and utilization of industrial zones to promote foreign direct investment), lowering cost of logistics, and facilitating smooth governmental procedures. They will also identify challenges of specific industrial sectors and the means to mitigate these challenges.

This task force, co-chaired by the Secretary, Department for Promotion of Industry and Internal Trade (DPIIT), Ministry of Commerce and Industry, Government of India and the Vice Minister for International Affairs, METI, Government of Japan, will collaborate with the relevant ministries and industries to achieve the vision of a globally competitive and vibrant Indian manufacturing sector.

Solution for Smart Cities

Japan International Cooperation Agency (JICA) to provide a concessional loan of ₹ 500 crore for smarter mobility project in Chennai to develop intelligent transport systems for an efficient traffic management system to ease the city’s congestion and promote economic growth

JICA has signed an agreement with the Indian government for setting up of a Chennai-based seawater de-salination plant at an ODA amounting to INR 1,800 crore.

Top Japanese Sectors in India

The Japanese presence in India spans across a wide range of sectors including, but not limited to, automobile, chemicals, textiles and renewable energy. Japanese companies operating in these sectors have not only been immensely successful in India but have also reaped rich dividends on their investments made into the Indian market, reflecting the strong foundations and resilient nature of India’s economy. The broad success of Japanese firms in India has played an important role in maintaining and even enhancing the attractiveness of the Indian market within Japan’s business community.

A brief snapshot of the top sectors in which Japanese firms operate in India:

Japan Industrial Townships (JITS)

On April 30, 2015, India’s Minister of Commerce and Industry, Nirmala Sitharaman, and Japan’s Minister of Economy, Trade and Industry, Yoichi Miyazawa signed the India-Japan Investment and Trade Promotion and Asia-Pacific Economic Integration and agreed to take steps to develop 11 potential sites as Japanese Industrial Townships in India. JITs are envisaged as integrated industrial parks with readymade operational platforms, well-equipped and world-class infrastructure facilities with plug-in-play factories and investment incentives for Japanese companies. Japan is the world’s only country that currently has 12 dedicated country-focused industrial townships in India.

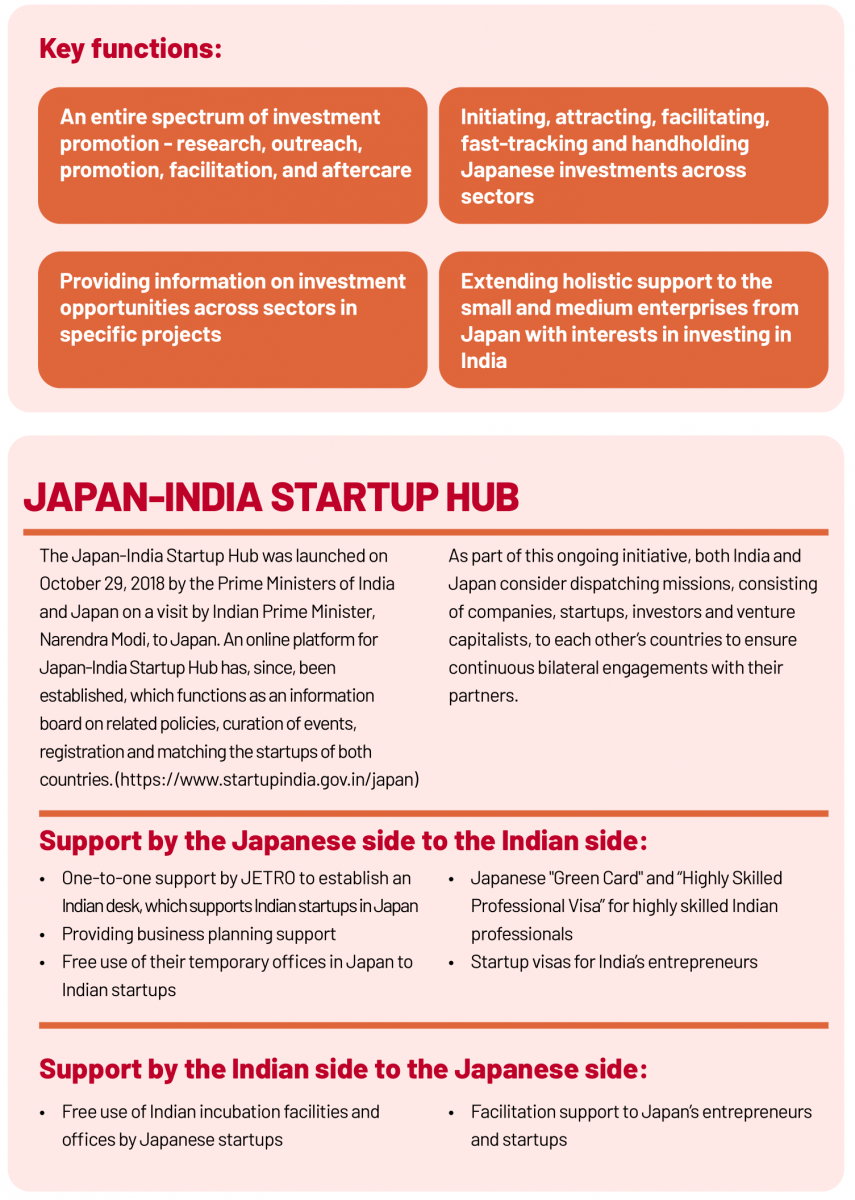

Japan Plus Desk at Invest India (Partnered with METI)

The Japan Plus desk at Invest India is the one-stop-shop for exploring and materializing India-entry plans for Japanese companies by working closely with the union ministries, states and regulatory authorities. Comprising of officials from India as well as from the Ministry of Economy, Trade and Industry from Japan, this desk seeks to further expand bilateral engagements between both the countries. To this end, Invest India and Japan External Trade Organisation (JETRO) signed a Memorandum of Cooperation (MoC) on May 1, 2018 with the stated intention of “strengthening their investment promotional activities to encourage further Japanese investments into India”. In continuation and recognition of increased cooperation between India and Japan, a MoU was signed between Invest India and Japan Innovation Network on June 29, 2018. Such cooperation further complements the other functions of the Japan Plus desk at Invest India.

India's Advantages as the Destination for Higher Japanese Investments

The labour advantage

Among the many synergies converging in the Indo-Japanese ties, the availability of a large pool of cheap labour in India stands out distinctly as it perfectly addresses the issue of lack of labour in Japan due to its ageing population. India, as the world’s youngest large country, with an estimated average age of 29 years by 2025, is aggressively skilling its large pool of manpower to address domestic and global demands for labour.

Investment Opportunities

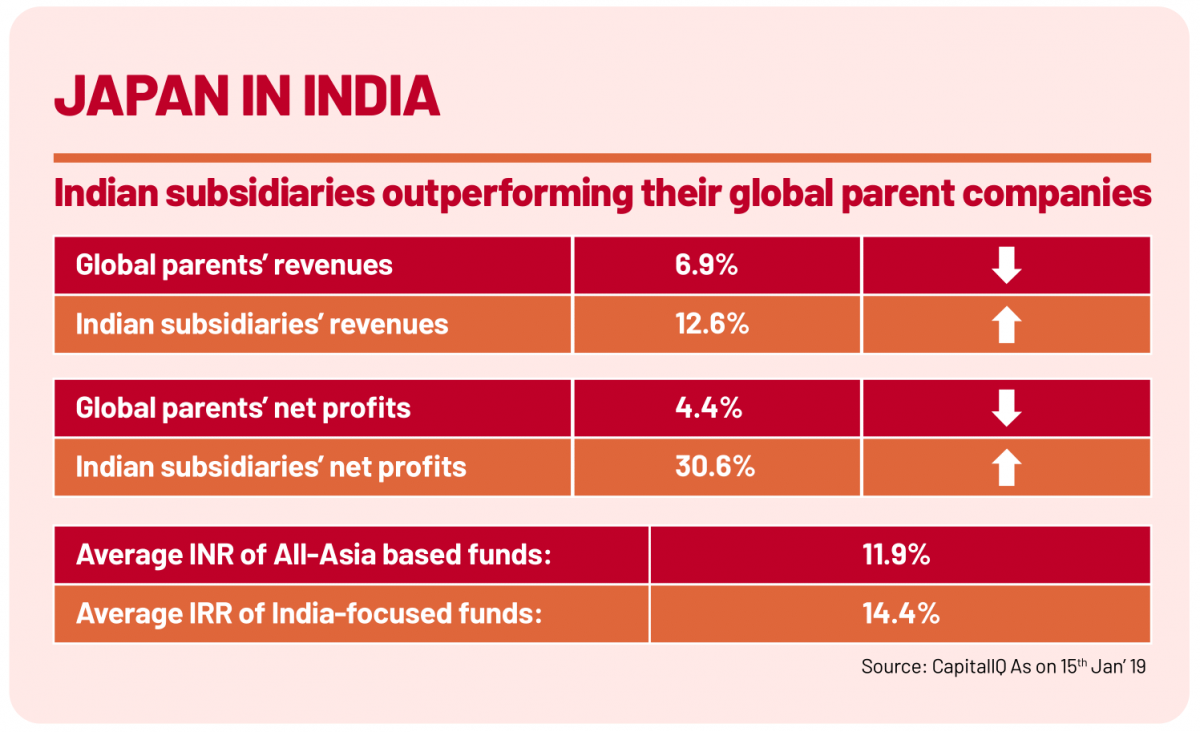

India, with its impressive and consistent growth rates, has attracted some of the highest FDI figures in the world since it liberalised its economy in 1991. In the backdrop of its growing economy, India is estimated to provide $ 4.8 Tn investment opportunities by 2025. During 2012-2017, several Indian subsidiaries of global corporates have continuously outperformed their global parent companies, demonstrating the strong growth prospects for investing in India. As of 2018-19, Japanese FDI into India stood at $ 2.96 Bn.

Mutual Trade

Trade between both the partners has been growing and deepening significantly reflected in the presence of 1,441 Japanese firms operating in India, in sectors ranging from automobiles to food processing and from renewable energy to textiles.

In 2018-19, India’s imports from Japan stood at $ 12.7 Bn, while Indian exports to Japan have followed a similar trajectory of growth, standing at $ 4.8 Bn in 2018-19.