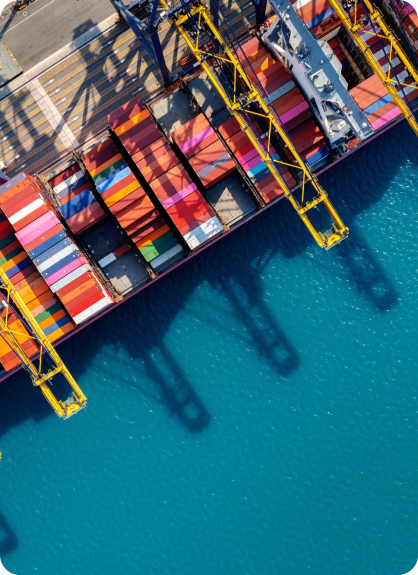

Why Invest in Ports & Shipping

-

Strategic Location

India is situated on major global shipping routes with a long coastline of over 11,098.81 Kms. This strategic location makes it a vital hub for trade and commerce

-

Government Support

Government is actively promoting the development of the ports and shipping sector through initiatives like the Sagarmala Programme, Maritime India Vision 2030, and the National Monetization Pipeline. These programs aim to modernize ports, improve logistics efficiency, and attract investments in the sector

-

Sustainability Focus

Government has launched initiatives like Harit Sagar Green Port Guidelines and Green Tug Transition Program, which promote sustainable practices like using renewable energy, reducing emissions, usage of green tugs at all major ports and others

-

Favourable Investment Climate

The government allows 100% Foreign Direct Investment (FDI) in port development