Foreign participation in India’s debt market is regulated and must be routed through one of three main routes: Foreign Portfolio Investment (‘FPI’), Foreign Venture Capital Investment (‘FVCI’), or External Commercial Borrowings (‘ECB’). The FPI and FVCI regimes are subject to compliance requirements mandated by the Securities and Exchange Board of India, while the ECB framework is regulated by the Reserve Bank of India.

Over the last few years, the increased demand for funds in India has elevated the need for simplified processes of raising debt. To further encourage foreign investment and improve the ease of doing business, the RBI systematically liberalized the ECB Framework in January, 2019. It broadened the eligible list of borrowers taking the ECB route, reduced the minimum maturity conditions, and homogenized rules for borrowers from different sectors.

Salient changes and takeaways brought in during the liberalization are explained below.

Merging of Tracks and Minimum Average Maturity Period: For simplifying the procedure, RBI merged tracks whereby the foreign currency denominated ECBs are now clubbed into a single track as against two tracks earlier for the medium term (maturity of three to five years) and long-term foreign currency ECB (maturity of over 10 years). Track III now comprises of Rupee denominated ECB and masala bonds and therefore prior approval of RBI is not required for issuing Rupee denominated bonds if all other conditions under automatic route are fulfilled.

The minimum average maturity period for all ECBs has been prescribed as three years, except those raised from foreign equity holders and utilized for working capital purposes, general corporate purposes or repayment of rupee loans, where it will be five years. A special dispensation to the manufacturing sector has been given for raising up to $ 50 mn with the maturity of one year.

ECB Limits: Sector specific and different ECB limits have been removed and ECB up to $ 750 mn per financial year can be raised under the automatic route. In case of foreign currency denominated ECB raised under the automatic route, the borrowers ECB liability-equity ratio cannot exceed 7:1 if outstanding amount of all ECBs, including proposed one, exceeds $ 5 mn.

Forms of ECB: Earlier both rupee and foreign currency denominated ECB raised as loans, securitized instruments (e.g., floating/fixed rate bonds, non-convertible, optionally convertible or partially convertible debentures), trade credits beyond three years or financial lease. Now rupee-denominated ECB can be availed in the form of preference shares. Foreign Currency Convertible Bonds (‘FCCBs’) as well as Foreign Currency Exchangeable Bonds (‘FCEBs’) continue to be a mode for availing foreign currency denominated ECB.

Eligible Borrowers: The list of ‘eligible borrowers’ has been expanded to include all entities eligible to receive foreign direct investment. Additionally, port trusts, units in special economic zones, SIDBI, EXIM Bank, registered entities engaged in micro-finance activities, which include registered not for profit companies, registered societies/trusts/cooperatives, and non-Government organizations, can now avail ECB.

Recognized Lender: The RBI has specified certain categories of entities which could provide ECB to eligible Indian borrowers. These recognized lenders include any resident of Financial Action Task Force or International Organization of Securities Commission compliant country. Additionally, Multilateral and regional financial institutions, where India is a member country, will be recognized as lenders.

All in Cost Ceiling: It includes the rate of interest, other fees, expenses, charges, guarantee fees, Export Credit Agency charges, whether paid in foreign currency or Indian Rupees (INR). This will not include commitment fees and withholding tax payable in INR. In case of fixed rate loans, the swap cost plus spread should not be more than the floating rate plus the applicable spread.

The ECB framework revisions discussed above are only a few of the many changes introduced by the RBI. Others include the opening of ECB for distressed assets where bidders of insolvent companies can raise debt from overseas investors.

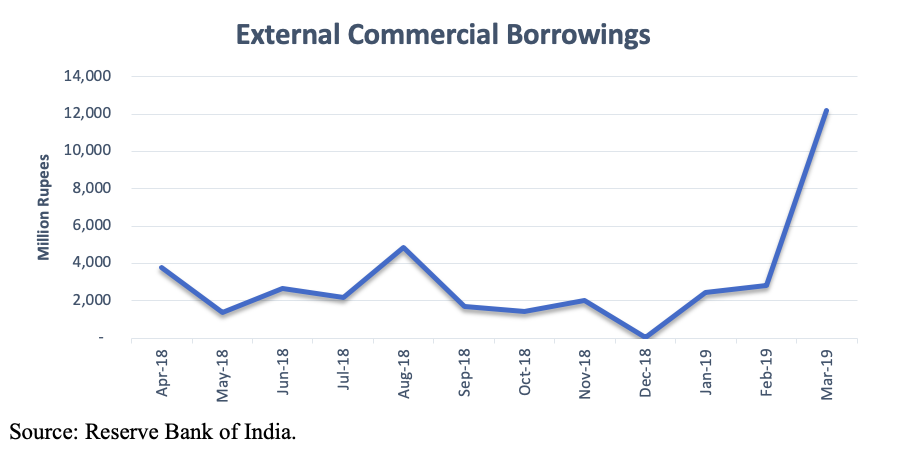

Over the last one year, ECB inflow in India has been in the range of INR 3 bn, reaching a low in December 2018. With the relaxation of norms in January and February, there has been a surge in ECB inflows.

To sum up, the RBI with an intent of easing investment norms and raising foreign investment in the country has introduced various relaxations in the framework. These structural changes have created a surge among investors. These positive changes are expected to increase investor interest in India, and their real effect and impact will become clear in due course of time.

The Financial Investments team at Invest India focuses on facilitating institutional investors to invest in the country, support in policy analysis and handhold during their investment journey.