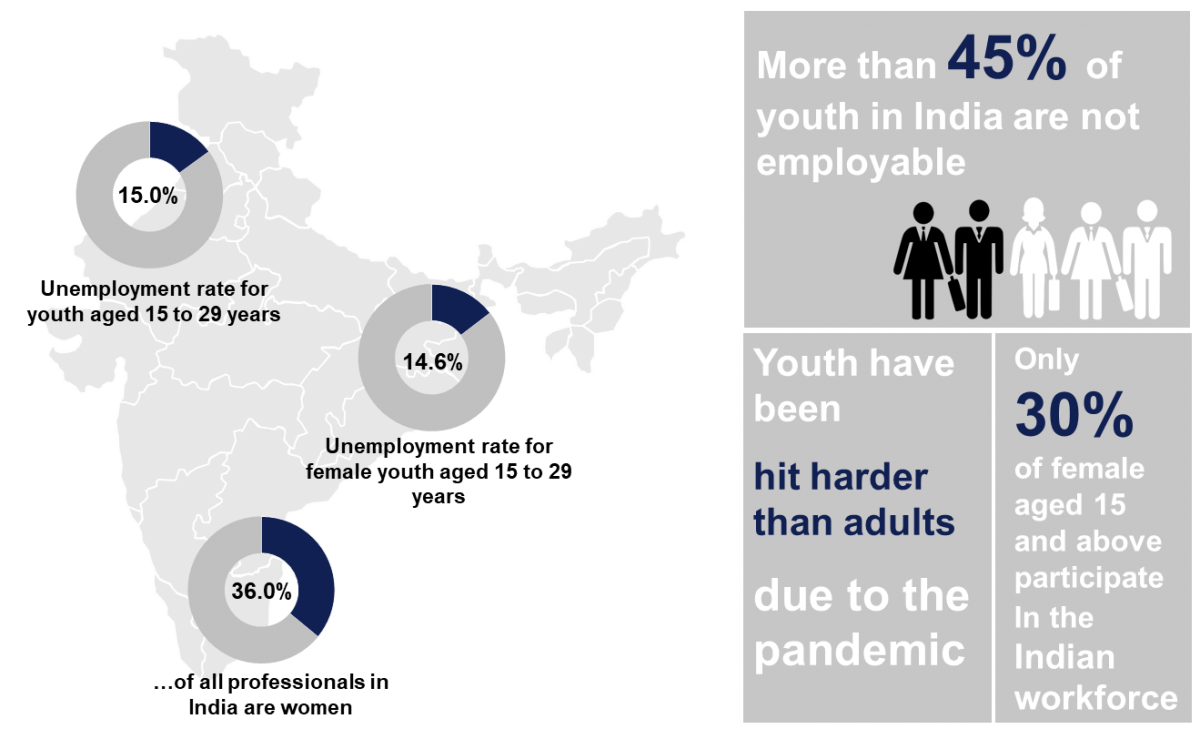

A multitude of agencies are working on bridging the skill gap, in urban and rural India, to address the youth employment issues, with a focus on young women. Investing in unique skill development models has the potential to increase the skills of the existing and future workforce.

India is driving unique avenues to transform its demographic potential into a dividend that will act as a catalyst to increase the country’s growth. One of the recent models adopted is the launch of India’s first skill bond by the National Skill Development Corporation (NSDC) in collaboration with a multitude of partners, namely, HRH Prince Charles’s British Asian Trust, the Michael & Susan Dell Foundation (MSDF), The Children’s Investment Fund Foundation, HSBC India, JSW Foundation and Dubai Cares, with FCDO (UK Government) and USAID as technical partners.

The announced Skill India Impact Bond aims to support 50,000 youth in India over four years, of which 60 per cent will be women and girls. The youth will be imparted with skills through training and provided access to wage employment in COVID-19 recovery sectors such as retail, apparel, logistics, to name a few. The collaborators of the bond have raised funds worth US$ 14.4 million for the youth skilling programs. The investment has a gender lens laying special focus on women and girls’ beneficiaries. It is a major step towards Gender Lens or Gender Smart Investing, which is an approach to mainstream gender factors in business investments to yield higher economic, social, environmental, and return on investment outcomes, mitigate risks and explore new opportunities for investments that create a gender-inclusive environment in investing.

Impact bonds mentioned above are a results-based financial tool that leverages private sector capital and expertise, with a focus on achieving results. It concentrates on performance and results. In impact bonds, risk investor provides upfront capital for social programs, and this investment is repaid—often with interest—based on the program’s achievement of predetermined outcomes to outcome funders.

The outcome funders of the Skill Impact Bond are brought together by the British Asian Trust. All the funders onboard have their respective strengths, perspectives, knowledge and learnings in the skill and education areas, used in the design of the impact bond. The outcome fund supporting agencies are CIFF, HSBC India, JSW Foundation and Dubai Cares. The risk investors, NSDC and MSDF, have committed US$ 4 million as upfront working capital to the service providers for the implementation of the program for four years. If the outcomes are achieved, the funding from risk investors will be ploughed back each year.

The training programs will be imparted by NSDC’s affiliated training partners, namely, Apollo Medskills Limited, Gram Tarang Employability Training Services Private Limited, Learnet Skills Limited, Magic Bus India Foundation and PanIIT Alumni Foundation.

The outcomes outlined will be evaluated by Oxford Policy Management. The performance manager for the bond is Dalberg Advisors that will measure the outlined outcomes to assist the delivery partners to stay on track to achieve outcomes. The legal partner for the bond is Nishith Desai Associates.

The above collaboration also intends to build the capacity of India’s skilling and Technical and Vocational Education and Training (TVET) ecosystem via knowledge sharing and promotion of good practices. The stakeholders have decided to promote effective interventions, support research, and enhance the impact of the skill development program.

Such impact bonds focus on transforming traditional funding mechanisms by philanthropists and development agencies. In such a setting, all collaborators are incentivized to achieve learning outcomes and the return on investment is high. Additionally, their focus on gender outcomes makes them socially and economically better investment instruments.

Public and private sectors should start engaging in such impact investments across sectors that also have a gender lens to contribute to economies by unlocking the potential of women as clients and customers and to Sustainable Development Goals to address development challenges, such as women’s access to education, employment opportunities, health services, water, sanitation, and reducing gender-based violence.

This article has been authored by Guriya.