Overview of Research & Development (R&D)

Importance of R&D

There is ample global evidence that R&D is a key driver of productivity and economic growth. It has been observed that two-thirds of economic growth in Europe between 1995-2007 was attributed to R&D, which accounted for 15% of all productivity gains for this period. An increase of 10% in R&D investment leads to 1.1-1.4% increase in productivity. The global R&D expenditure has been rising over the last decade. In 2017, it was estimated to be $1.7 tn in Purchasing Power Parity (PPP) terms. US, China and Japan were the leading countries in R&D. India’s share was around 2.8%. The Government of India is continuously focussing and emphasising on science and technology, to increase its efforts and make improvements in R&D.

R&D has contributed to capital formation, export of services and Foreign Direct Investment (FDI). This is in addition to the fact that the contribution of R&D to social well-being is also phenomenal. R&D has played a crucial role to anticipate and respond to these needs. Investing in R&D is fundamental to India’s national security and to address the multiple uncertainties stemming from climate change and the global meltdown.

R&D in India: The Promise it Holds

According to United Nations Educational, Scientific and Cultural Organisation (UNESCO) Institute for Statistics, India is amongst the top ten R&D spenders in the world, i.e. $48.1 bn R&D spending (adjusted for PPP) constituting 2.7% of the global share. India improved its ranking in the Global Innovation Index by five places to 52nd in 2019 and is likely to get into the list of the top 25 nations by 2027. With growing globalization, engineering, and R&D, the market in India is estimated to grow at a CAGR of 14% to reach $42 bn by 2020.

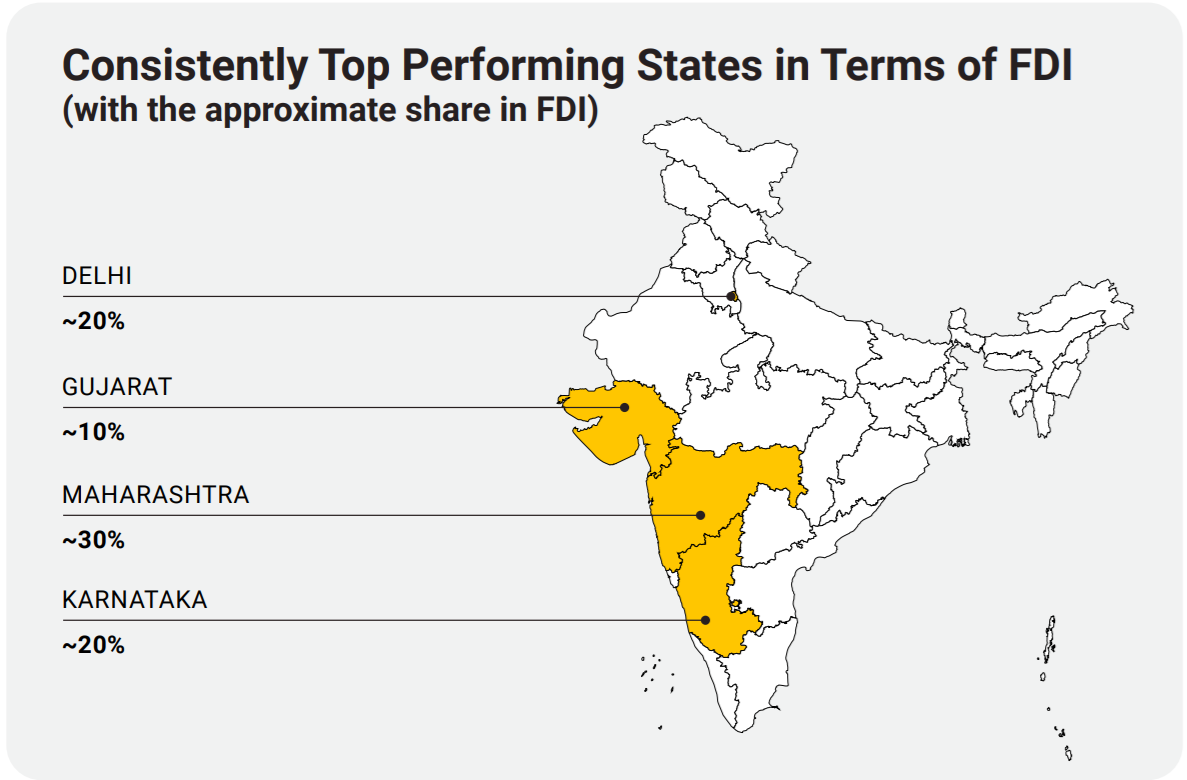

In 2019, India had close to 7000 R&D institutions. The maximum number of R&D institutions i.e. 1392 (20.3%) are in the state of Maharashtra followed by Karnataka, Tamil Nadu, Andhra Pradesh and Gujarat with 685 (10%), 672 (9.8%), 570 (9.7%) and 547 (8.3%) respectively. India accounted for 40% ($13.4 bn) of the total $34 bn of globalised engineering and R&D spending in 2016.

FDI in R&D: The opportunities

There was a major inflow of FDI in R&D in 2015-16 [approximately $ 235 Million (Mn)]. While it has dropped in subsequent years, there is a massive opportunity in this space.

- There are only 26 Indian companies in the list of the top 2,500 global R&D spenders compared to 301 Chinese companies.

- 19 out of 26 firms, in India, are in just three sectors: pharmaceuticals, automobiles and software.

- India has no firms in five of the top ten R&D sectors as opposed to China that has a presence in each one of them.

Need for FDI in India's R&D Sector

- Diverse intellectual capital

- India adds 6000 PhDs, 200k engineers, 300k non‐engineer postgraduates, and 2.1 Mn other graduates to its workforce annually. In 2016, India produced the maximum number of graduates worldwide with 78 Mn fresh graduates, of which 2.6 Mn were from Science, Technology, Engineering and Math (STEM).

- Frugal innovation advantage

- Frugal innovation is a strength for India. Investment in R&D within frugal innovation would result in substantial economic advantage

- Availability of a low cost R&D talent pool

- Cost of hiring a researcher in India is 1/5th of the cost in US.

- Opportunity to address India and similar markets

- According to a World Economic Forum (WEF) report, India is poised to become the third-largest consumer market by 2030 globally, with consumer spending growing to $6 Tn, from $1.5 Tn in 2018.

- The Asia-Pacific will be responsible for the overwhelming majority (90%) of the 2.4 Bn new members of the middle class entering the global economy.

- Conducive IPR policy

- Compliant with Trade-Related Aspects of Intellectual Property Rights (TRIPS).

- India was one of the top three countries to show a strong growth in Patent Cooperation Treaty (PCT) filings in 2018

- Massive startup ecosystem

- Ranked second after US to host the largest number of startups.

- Accelerator programs mentoring startups powered by global giants.

- 1500+ global in-house centers operated by MNCs across India.

- A progressive policy environment

- India’s ranking in the World Bank’s Ease of Doing Business index rose by 14 spots to 63rd in 2018-19.

- Resolving insolvency, dealing with construction permits and trading across borders are areas of strength for India.

- One of the primary aims of the Science and Technology Policy, 2013 is to increase private sector investment in R&D.

- Robust academic and research infrastructure

- Currently, over 1,140 centers in India are dedicated to R&D which employ over 900,000 professionals.

- India has been ranked as the top innovation destination in Asia and second in the world for new innovation centres. It accounts for 27% of Asia’s new innovation centres.

MNCs placing their bets on India

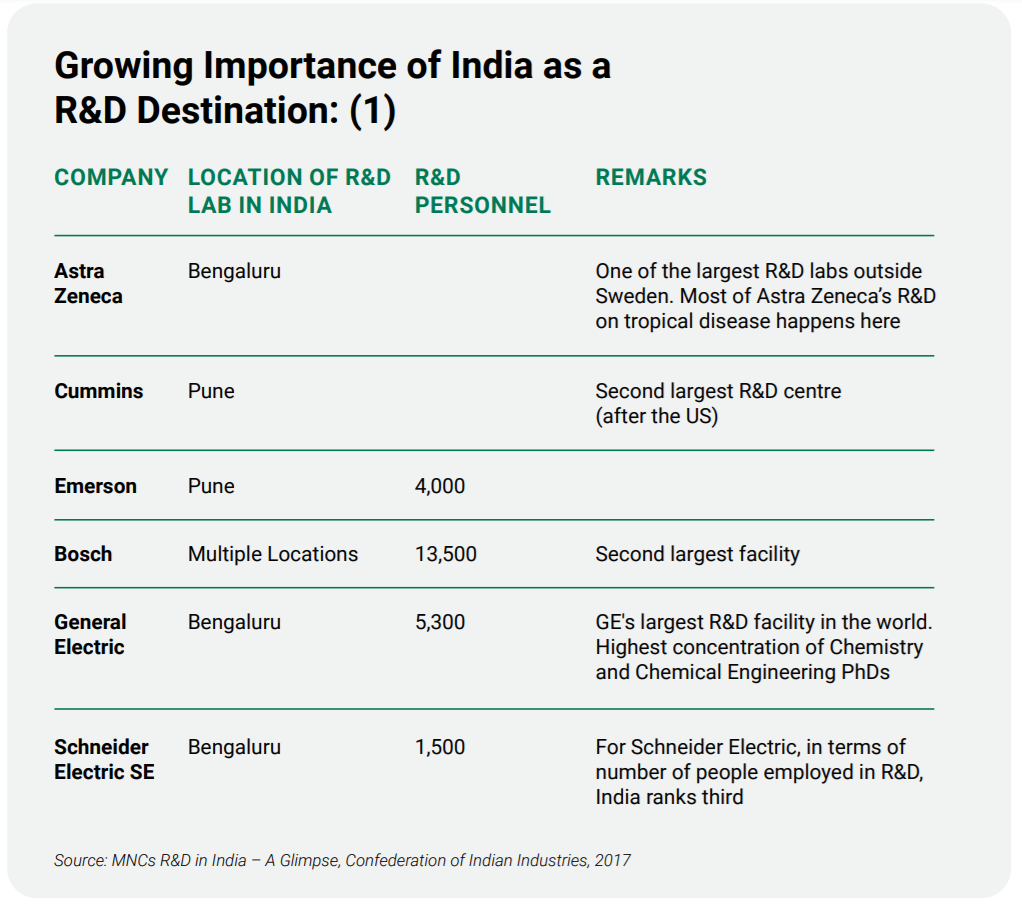

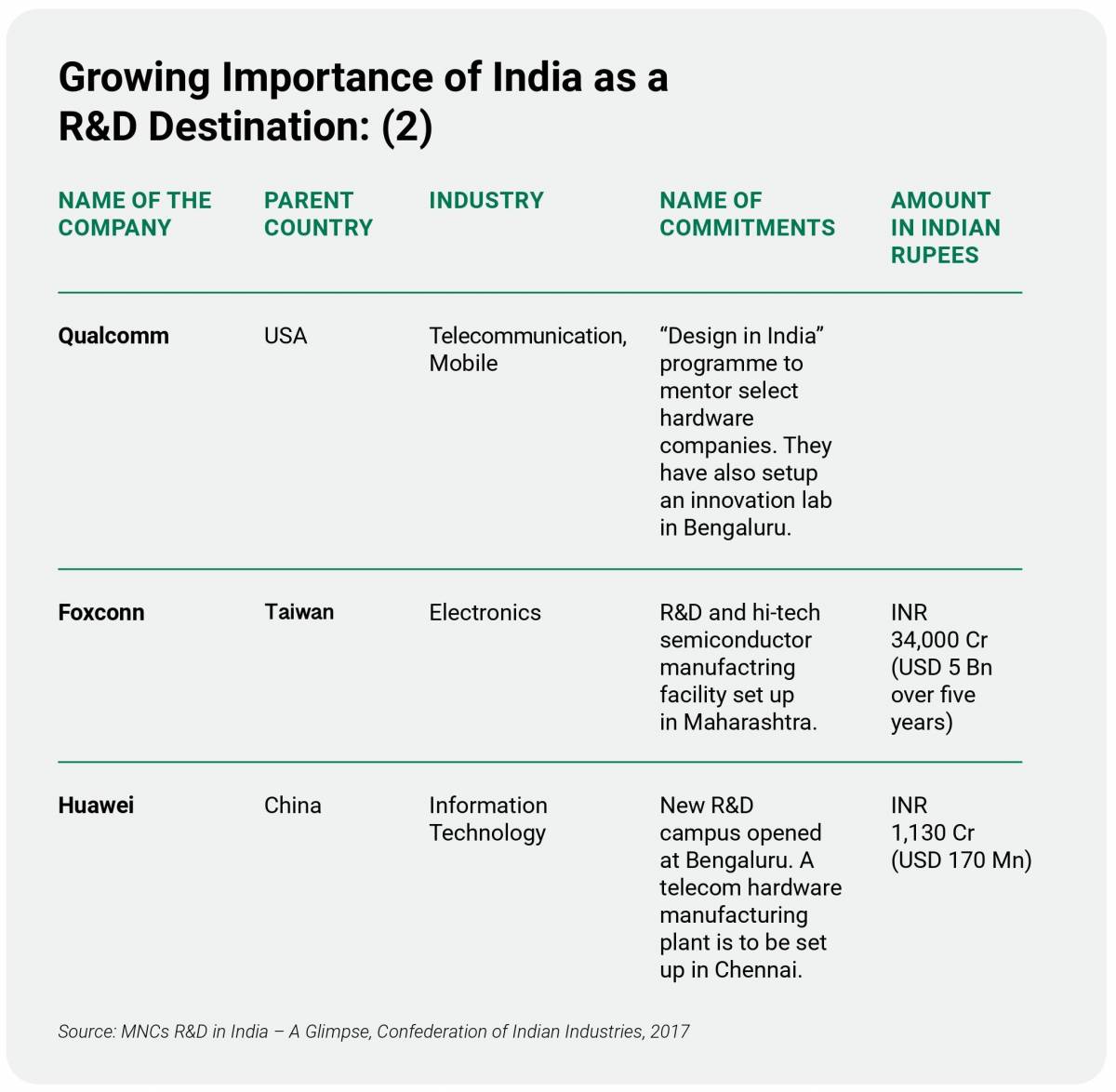

India is fast becoming a top R&D outsourcing destination with 60 per cent of new MNCs having established global in-house R&D centres. This is likely to accelerate as new MNCs eye India to set up their bases. As per a study by Confederation of Indian Industry (CII) published in 2017, from among the top 100 global R&D spenders, around 83 of them have a presence in India in some shape or form. Companies like Microsoft, Oracle, Motorola, Intel, IBM and GE have set up their R&D or design centres in India. Companies like GE and Bosch have their largest and second largest R&D facilities respectively in India.

Growing Importance of India as an R&D Destination:

Significant Employment Generation Potential

For every $1 mn invested in India, per year for the purpose of R&D by MNCs, it is likely to create demand for around eight to ten researchers.

Distribution of R&D Spending in India

R&D Expenditures in India

The gross R&D spending in India has shown a healthy growth in the past few years, increasing from $3,963.45 mn in 2005-06 to $11,298.46 mn in 2014-15 at a CAGR of 12.3%.

- Gross Expenditure on R&D (GERD) has shown a consistently increasing trend over the years. It has tripled in the last decade in nominal terms – from $3,193.46 mn in 2004-05 to $13,885.59 mn in 2016-17.

- As a fraction of GDP, public expenditures on R&D has been stagnant – between 0.6-0.7% of GDP – over the past two decades

R&D: Promising Sectors

- Healthcare: The healthcare industry spent $782 bn on R&D in 2018 and is poised to have the highest R&D expenditure by 2020. The healthcare market in India is expected to be among the top three in the world by 2020 and therefore, presents a tremendous opportunity to investors within the sector

- Automotive: In 2018, the automotive industry spent $130 bn on R&D, marking a growth of 6-7% from 2017. A key sub-sector driving the investments in R&D is electric mobility.

- Software and IT: In 2018, the Software and IT sector accounted for $117 bn of the R&D spend, registering a growth of 18-19% over 2017. In India, this is reflected by the fact that $1.6 bn is spent annually on training workforce and growing R&D.

- Semiconductors: With a 7-8% growth rate, the semiconductor sub-sector is among the top five industry spenders on R&D with an investment of $61 bn. The sector is characterised by rapid technological changes, which demand high levels of spending on R&D.

India's aim in the R&D Segment

- More than double the expenditure on R&D to about two per cent of GDP by 2022.

- Target 50% of the global R&D market.

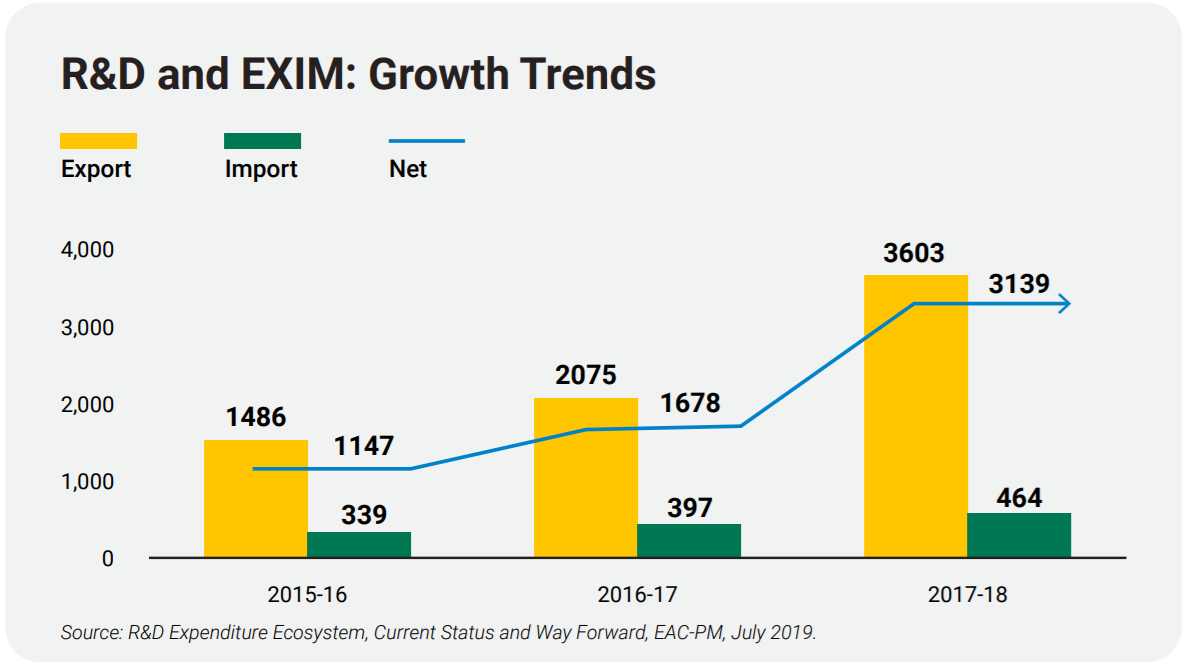

- Double the exports of R&D from $3 bn to $6 bn.

- Create 30 dedicated R&D export hubs.

- Target FDI investment of $500 mn by 2022.

- Aspire to be one of the top ten global R&D institutions in emerging technologies.

Key Focus States for R&D

The key states for R&D operations are Karnataka, Telangana, Tamil Nadu, Haryana, Uttar Pradesh, Maharashtra, Gujarat and Rajasthan.

Initiatives, Incentives and Programmes

Fiscal Incentives

To encourage investments in R&D, the Government of India offers various tax incentives. Some of these incentives are given below:

- The corporate tax rate for existing companies has been reduced to 22% plus surcharge under section 115 BAA.

Other incentives include:

- Accelerated depreciation allowance at 40% for investment on plant and machinery and on indigenous technology as against 15% for normal depreciation as per rule 5(2) of IT rules.

- Customs and central excise duty exemption to in-house R&D units of industry.

- Excise duty waiver for three years on goods designed and developed by a wholly-owned Indian company and patented in any two countries out of India: USA and Japan; and any one country under the European Union (to be viewed in relation with the GST regime).

- Exemption from customs duty on imports made for R&D projects funded by the government in industry.

Recommendations

There is a need for an enabling ecosystem with policy support, innovative solutions, risk mitigation to make R&D in India attractive. The following focus areas may be considered:

- More participation by states.

- Tracking of MNC’s R&D activity.

- Developing human capital for R&D work.

- Improving contract enforcement.

- Foster linkages between MNCs and local entities.

- Improving land and infrastructure.

- Providing incentives based on expectations of MNCs.

- Formulate long term government priorities for R&D ecosystem to enable industry alignment.

- Develop forward looking policy measures benchmarked to global best practices to help innovations.

- Engage young generations in R&D for a strong foundation for a career in research. Industries should collaborate with professors for research-based activities.

Sector-wise Outlook for FDI in R&D

Overview and Major Players

- The Indian logistics sector, already a $200 bn market, is set to grow at over 10% CAGR in the next five years to reach around $320-330 bn by 2024-25.

- Technical textiles in India have already established a market size of $17 bn, nearly 7% of the world market size of $250 bn.

- Government of India seeks to realise the electric dream of 400 Mn customers by the year 2030. Investment in Electric Vehicle (EV) startups has grown from $20 mn in 2017 to $406 mn in 2019.

- The Biotechnology sector of India is highly innovative and is on a strong growth trajectory. The sector, with its immense growth potential, will continue to play a significant role as an innovative R&D and a manufacturing hub. It is already a $62.5 bn market and is set to reach $150 bn by 2025.

- The ESDM sector in India has witnessed exponential growth in the past five years and is estimated to generate $100-130 bn in economic value by 2025. Government of India has taken value initiatives to promote electronics manufacturing in the country, with a target of achieving positive net exports by 2025.