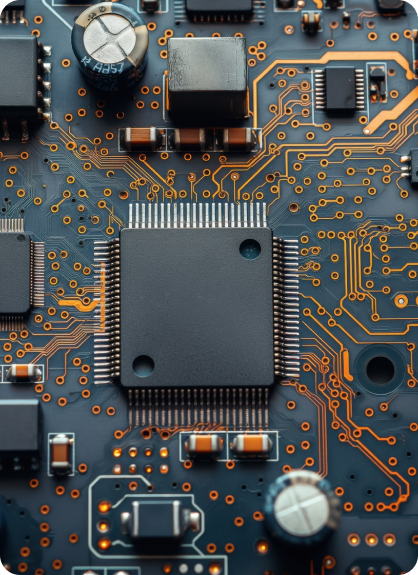

Why Invest in Electronic Components Manufacturing

-

India’s economic growth

India is the world’s fastest-growing major economy, with strong household consumption and public investment in infrastructure.

-

Expanding Market

The electronics market in India is expanding due to rapid urbanization, rising disposable incomes, and digitalization efforts across sectors.

-

Robust ecosystem

India’s diverse and huge talent pool and the presence of global companies in the tech, component manufacturing, and automobile industries are significant demand drivers.

-

Policy incentives

The presence of PLI and other schemes to boost domestic manufacturing.

Incentives & Schemes

-

Scheme for Promotion of manufacturing of Electronic Components and Semiconductors (SPECS)