India's electric mobility transition has accelerated rapidly, driven by strong policy support, declining battery costs, and a growing domestic manufacturing ecosystem. The country is reshaping itself from an import-dependent market into a globally competitive hub for EV production, aligned with its strategic priorities of energy security, reduced oil imports, and achieving the 2070 net-zero vision[1].

The shift is already visible on the ground. EV sales have surged from 50,000 units in 2016 to 2.08 million in 2024[2], making India one of the world's fastest-growing EV markets. India's EV penetration spans across two-wheelers, three-wheelers, passenger vehicles, and commercial fleets, with the bulk of adoption driven by affordable 2Ws and high-utilisation 3Ws that dominate urban and last-mile mobility. Passenger EVs are steadily gaining momentum, while electric buses and commercial fleets are becoming integral to public transport and logistics.

With demand and production incentives, localisation policies, and early charging infrastructure in place, India has entered a decisive phase of scale. As global supply chains realign, India stands out as one of the most attractive destinations for EV manufacturing investment.

Current State of EV Manufacturing in India

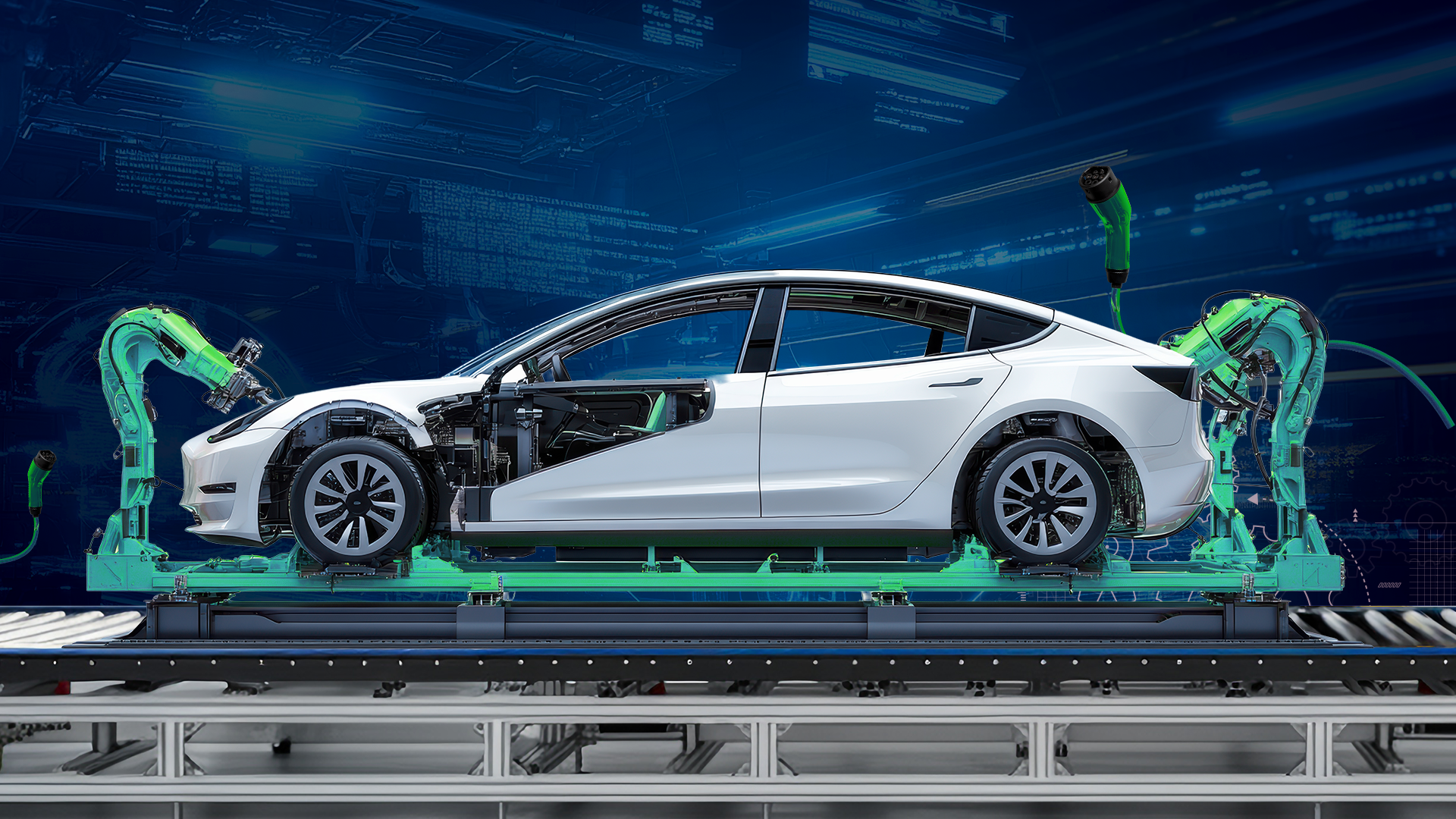

India is evolving from an assembly-led market to a full-fledged manufacturing hub. Domestic production now spans battery packs, motors, drivetrains, power electronics, wiring harnesses, and charging equipment, supported by a rising base of component suppliers and contract manufacturers.

Leading OEMs such as Tata Motors, Mahindra, TVS, Ather Energy, Ola Electric, Bajaj Auto, and PMI continue to expand capacity, supported by new investments across R&D, gigafactories, and dedicated EV platforms. Global players, including VinFast, Tesla, and Korean and Japanese battery companies, are also exploring India for large-scale manufacturing.

Overall, India's EV manufacturing capability is deepening rapidly, laying the foundation for increased localisation, cost competitiveness, and integration into global supply chains.

Government Policies Driving EV Manufacturing

The progress so far has been made possible by a forward-looking and purposeful policy framework, both at the national and state levels, to accelerate adoption, build local capacity, and strengthen supply chains. Few such policies are

National Policies

- Adoption and Manufacturing of Hybrid and Electric Vehicles in India (FAME I and FAME II) and PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-DRIVE) scheme[3]

India's EV transition has been strongly shaped by a decade-long incentive architecture—FAME-I (2015–19), FAME-II (2019–24), EMPS-2024 (Apr–Sep 2024), and now the PM E-DRIVE, launched in October 2024 with an outlay of ₹10,900 crore[4]. These schemes have enabled faster EV adoption, expansion of charging infrastructure, and strengthening of domestic manufacturing capabilities.

As of June 2025, these schemes have supported over 1.88 million EVs and installations of ~9,400 EV Public Charging Stations (EVPCS)[5]. Further, an allocation of Rs 2,000 crore has also been made under the PM E-DRIVE Scheme for the installation of 72,300 EVPCS.

- Production-Linked Incentive (PLI) Schemes for Auto and Advanced Chemistry Cells (ACC)

PLI Scheme for the Automobile and Auto Components, with an outlay of ₹25,938 crore[6], is a cornerstone of India’s efforts to localise EV manufacturing and reduce import dependence in advanced automotive technologies. Designed to offset cost disabilities and encourage fresh investments, the scheme promotes the indigenous production of Advanced Automotive Technology (AAT) vehicles and components, including EVs, power electronics, and high-value subsystems. Leading OEMs and suppliers such as Tata Motors, Mahindra, Hyundai, Ola Electric, Ather, TVS and several global firms have been approved under the scheme. As of December 2024, participating companies have committed over ₹25,000 crore[7] in capital investments for setting up new manufacturing lines, enhancing innovation capabilities, and expanding supply chain depth across the EV ecosystem.

Complementing this, the ₹18,100-crore PLI Scheme for ACC is building India's foundational battery ecosystem by incentivising large-scale domestic cell manufacturing. The scheme aims to establish 50 GWh of Giga-scale ACC capacity, with 40 GWh[8] already allocated to three beneficiaries - Reliance, Ola Electric, and Rajesh Exports. The scheme mandates stringent value addition, quality benchmarks, and phased localisation targets to ensure globally competitive manufacturing. By accelerating domestic cell production, the scheme is expected to significantly reduce India's battery import dependence, lower EV costs, and strengthen long-term energy security while positioning India as a major player in the global battery supply chain.

- Scheme to Promote Manufacturing of Electric Passenger Cars in India (SPMEPCI)

The SPMEPCI, launched with its online application portal going live in June 2025, aims to attract foreign investment and technology transfer for EV innovation. With a minimum investment of ₹4,150 crore[9], it incentivises OEMs to establish R&D and production facilities. Approved applicants can import up to 8,000 Completely Built-in Units (CBUs) of e-4Ws annually at 15% duty for five years (minimum CIF USD 35,000). The scheme balances technology infusion with domestic value addition, strengthening India’s premium EV manufacturing competitiveness.

State Policies

State governments have played a pivotal role in complementing central policies by offering targeted incentives to attract EV and component manufacturing. 29 states and UTs have notified dedicated EV policies[10], with four others in draft stages. These policies provide capital subsidies (~15–25% of fixed capital investment), preferential land allotment in industrial parks, stamp duty waivers, interest and power subsidies, and up to 100% SGST reimbursement, significantly reducing upfront costs for investors.

States such as Tamil Nadu, Maharashtra, Karnataka, Gujarat, Haryana, and Uttar Pradesh have emerged as major EV hubs through aggressive policy support and dedicated clusters, anchoring OEMs, battery producers, and component manufacturers.

Key Investment Trends in India's EV Manufacturing Ecosystem

India's EV sector is witnessing sustained investor confidence, with capital flowing across vehicle manufacturing, battery gigafactories, localisation of components, and charging infrastructure. The investment landscape is being shaped by five major trends:

- Domestic EV Manufacturing Capacity: Homegrown OEMs such as Tata Motors, Mahindra, TVS, Ola Electric, and Ather are undertaking aggressive capacity expansion to meet rising demand. Multiple greenfield and brownfield facilities are being set up across Tamil Nadu, Karnataka, Gujarat, and Maharashtra—supported by state incentives and PLI-linked commitments. The entry of VinFast[11] and new investments by MG Motor–JSW and Hyundai–Kia underscore India's growing prominence as a global EV production base.

- Battery & Cell Manufacturing: Cell and battery investments have become the fastest-growing segment, driven by the ACC PLI scheme. Reliance New Energy, Ola Electric, Amara Raja, Exide Energy, and international players are developing gigawatt-scale cell plants. The ecosystem is also witnessing investment across the value chain, including cathode/anode materials, electrolytes, pack assembly, thermal management systems, and recycling technologies.

- Localisation of Power Electronics & EV Components: India is ramping up localisation of high-value EV components such as motors, controllers, inverters, battery management systems, and chargers. Tier-I suppliers and global electronics companies are investing in dedicated EV lines, while newer entrants in semiconductors, magnet manufacturing, and drive electronics are exploring India in response to China+1 supply-chain realignment.

- Expansion of Charging Infrastructure: Private and public operators are investing in highway fast-charging corridors, urban charging clusters, battery swapping models, fleet-charging and renewable-powered hubs. Energy utilities and DISCOMs are entering long-term partnerships with charge point operators, improving grid readiness and reducing downtime.

- Venture & Corporate Investment in EV Startups: Venture capital funding remains strong in segments like battery innovation, EV financing, telematics, thermal management, software-driven fleet optimisation. Corporate venture arms of major OEMs and energy companies are actively investing in startups working on LFP/Sodium-ion chemistries, motor efficiency, BMS software, AI-based vehicle intelligence, and charging optimisation.

Emerging Priority Areas for India's EV Ecosystem

As India scales its EV manufacturing landscape, a few emerging priority areas offer room for further acceleration and targeted innovation.

- Deepening the Domestic Supply Chain: As EV production expands, there is a growing opportunity to enhance domestic manufacturing of cells, power electronics, semiconductors, and rare-earth-dependent components. India's focus on securing critical minerals globally, combined with incentives for local value addition, is steadily strengthening supply-chain resilience and reducing reliance on imports.

- Strengthening EV Financing Models for Fleets Segments such as electric buses, trucks, and last-mile commercial vehicles present significant growth potential. The next wave of innovation lies in developing specialised financing products, risk-sharing models, and data-driven credit mechanisms. These efforts are already gaining traction through government programmes and private financiers collaborating on EV-specific financial solutions.

- Expanding and Optimising Charging Infrastructure: India has made notable progress in public charging, and the opportunity now is to enhance utilisation through better geographic distribution, high-speed corridor networks, and grid-aware charging solutions. DISCOMs, CPOs, and infrastructure providers are increasingly aligning to create a robust, future-ready charging ecosystem.

- Enhancing Quality, Testing, and Safety Ecosystems: As volumes rise, India is placing significant emphasis on advanced testing facilities, standards harmonisation, and robust certification frameworks. This presents an opportunity for investment in state-of-the-art labs, fire-safety technologies, and high-quality components, further strengthening India's position as a trusted global EV manufacturing destination.

- Building a Future-Ready Workforce: The transition to EVs opens up space to expand India's pool of battery engineers, power electronics specialists, and advanced manufacturing technicians. This shift aligns well with India's skilling mission, creating an opportunity for industry–academia partnerships, specialised training centres, and upskilling programmes that support long-term competitiveness.

Market Outlook and Investment Opportunities

India's EV sector is projected to grow from $5.22 billion in 2024 to $18.3 billion by 2029, at a CAGR of 28.5%[12], making it one of the fastest-growing EV markets globally. This will translate into significant capacity additions across vehicles, ACCs, battery packs, power electronics, motors, chargers, and embedded software.

As domestic capabilities strengthen, India is also poised to emerge as an export hub for e-2Ws, compact EVs, battery packs, and key drivetrain components, supported by R&D investment and global partnerships.

Investment opportunities span greenfield and brownfield manufacturing, joint ventures, and technology-transfer partnerships. High-growth segments include cell and battery pack manufacturing, battery recycling, power electronics, magnet and motor technologies, charging hardware, and EV software platforms such as telematics, ADAS, and energy management systems. In parallel, local processing and refining of critical minerals—lithium, nickel, cobalt presents a strategically important long-term opportunity as India scales its ACC capacity and looks to reduce import dependence.

The Road Ahead

India's electric mobility journey has moved from early experimentation to a decisive phase of scale, powered by strong policies, growing manufacturing capacity, and rising investor confidence. Over the past decade, India has systematically built the foundations of a robust EV ecosystem—anchored by FAME I & II, PM E-DRIVE, the Automotive and ACC PLIs, and progressive state-level policies.

The coming decade will be fundamentally different. With demand accelerating, manufacturing capacities rising, and technology capabilities deepening, India is rapidly progressing toward becoming a global hub for EV manufacturing and R&D. The country's strengths—cost competitiveness, engineering talent, a growing supplier base, and a reform-oriented regulatory environment are creating structural advantages that few markets offer at a comparable scale.

For investors, the moment is both timely and strategic. Those who invest today stand to participate in one of the world's most transformative mobility transitions, backed by policy stability, rising demand, and an ecosystem rapidly scaling toward global leadership. Key opportunities now lie in strengthening supply chains, accelerating cell and component localisation, expanding charging infrastructure, and building a future-ready workforce—areas that will shape the next decade of sectoral growth.

As India advances on this trajectory, Invest India, the national investment promotion and facilitation agency of the Government of India, continues to support global and domestic EV companies in their India investment journey. We work closely with OEMs, battery manufacturers, component suppliers, and charging infrastructure players to navigate policies, identify suitable locations, access incentives, and establish meaningful partnerships across the value chain. We stand ready to support companies at every stage of their India journey and are committed to ensuring a smooth, end-to-end facilitation experience—from market entry to expansion.

This blog is written by Kuldeep Singla