India has been a hub for textiles throughout its history, boasting a strong traditional infrastructure for cotton, handlooms, and ready-made garments (RMGs) that stretches back centuries. Textiles, including handicrafts, remain one of India’s primary exports, accounting for nearly 8.21% of total exports in FY 2023-24.1

India alone supplies 3.9% of all global textiles, particularly to developed markets such as the US and the EU.2 India’s textile industry now has a new direction for growth and transformation. This direction is driven by green textiles and smart fabrics, an innovation within the textile industry.

India is developing the right infrastructure for these new-age textiles and smart fabric technology, bolstered by strong government support and a clear focus on the future. Currently, both private players and public institutions are actively investing in research, cleaner production methods, and new materials that meet global standards.

For investors willing to think ahead—toward sustainable fashion, fibres, intelligent fabrics and domestic innovation—this is the right time to enter. The textile industry presents a once-in-a-decade opportunity with smart fabrics and green textiles in India. Before we understand how it is necessary, we must first explore what green textiles and smart fabrics exactly mean.

India is at the precipice of green textiles

Global fashion and textile supply chains are under growing pressure to reduce their environmental impact. Consumers are increasingly aware of the environmental costs associated with fast fashion. To alleviate this pressure, green textiles emerge as a compelling alternative. These are primarily textiles made from organic materials and produced using environmentally friendly manufacturing techniques.

India, being a major textile producer, has the impetus to support the global move towards green textiles. The push to green textiles has two major advantages for India:

- It futureproofs our textile industry for the upcoming decades.

- It furthers our sustainability goals and supports our 2070 net-zero emissions target.3

The government has also identified this opportunity and is advancing the transition to green textiles by promoting the use of eco-friendly and sustainable fibres such as organic cotton, bamboo and hemp. In addition to the fabrics themselves, textile manufacturers are being introduced to innovative manufacturing techniques, including dope dyeing, digital printing, and the use of natural dyes, to optimise water usage and reduce chemical discharge.

India has set a goal for its textiles and apparel industry to reach $350 billion in value by 2030, 4 with $100 billion worth of exports, 5 driven by efforts to decarbonise, digitise, and reduce waste in production systems. These initiatives are expected to enhance operational efficiency, lower production costs, and align with global sustainability standards, thereby strengthening the sector’s competitiveness in international markets and attracting greater investment. From circular fashion to adopting renewable energy, India's textile sector is embracing diverse strategies to become more sustainable and efficient.

A key pillar of this transformation is the move towards sustainable fabrics and circularity, a practice deeply embedded in Indian tradition. India’s relationship with clothing has long been rooted in sustainability. Across generations, garments are purchased sparingly, worn for years, and given multiple lives - a saree may first be worn for special occasions, then as everyday attire, later repurposed into quilts or children’s clothing, and finally into cleaning cloths. Informal networks of kabadiwalas and itinerant traders collect and redistribute used textiles, while traditional crafts like kantha and khesh transform old fabrics into new creations. This deeply ingrained habit of reuse, repair, and repurposing has kept textiles in circulation far longer than in many modern consumption models, making circularity not a new trend in India, but an inherited way of life.

Now, this ethos is being scaled up with a focus on recycling. Textile manufacturers are actively adopting sustainable practices such as recycling, water conservation, and the production of bio-friendly textiles. For example, denim and woven apparel manufacturers in Bengaluru have implemented Zero Liquid Discharge (ZLD) technology to recycle wastewater. In parallel, brands are also shifting to eco-friendly packaging to minimise plastic use and support the circular economy6.

This movement has also gained momentum at the national level. In 2019, the central government launched 'Project SU.RE' to promote sustainability within the fashion industry. As part of this initiative, 30 Indian fashion companies committed to sourcing or using a significant proportion of their raw materials from sustainable sources by 2025.7

India’s push towards a $350 billion textiles and apparel industry by 2030 is underpinned by a series of sustainability-focused initiatives. The InTex India programme, a four-year collaboration (2023–2027) between UNEP and the Ministry of Textiles, is working with SME textile clusters like Surat and Karur to adopt circular practices through life-cycle assessments and eco-innovation frameworks.8 Complementing this, the Ministry is formulating a Draft Roadmap 2047—a long-term, stakeholder-driven plan to make the sector sustainable, circular, and resource-efficient, positioning sustainability as a global competitive advantage rather than mere compliance.9 To support this transition, the government is developing a CIBIL-style credit rating system and a Common Green Fund to ease financing for MSMEs investing in sustainable production.10 Further, academic institutions such as IIT Delhi, NIFT, and NID are introducing specialised courses to embed sustainability principles into fashion education, ensuring a skilled talent pipeline for a greener future.

Other methods of ensuring greener textile production involve enzymatic treatments to replace conventional, chemical-intensive methods in processes such as desizing and bleaching, which reduce energy and water consumption. Reusing water is another solution on the table for textiles. Last but not least, technologies such as zero-liquid discharge (ZLD), ozone fading in denim production, and plasma treatments for fabric finishing are gaining traction in India's textile hubs.

Smart fabrics: An innovation in technical textiles

Another significant shift is the increasing interest in smart textiles, a subset of technical textiles. These fabrics utilise specialised man-made materials and are sometimes outfitted with electronic sensors or other devices to perform specific functions. Such textiles find applications in various sectors, including defence, sports, healthcare, and agriculture.

Fabrics with temperature-regulating properties or uniforms that track biometric data are examples of smart textiles. Smart fabric technologies also include innovations such as agricultural nets with built-in UV protection alerts and clothing that adjusts insulation based on the wearer’s environment. These advanced fabrics often integrate with mobile apps and cloud platforms to enable real-time monitoring and analysis.

India is emerging as a key player for technical textiles with exports worth ~₹21,407 crore in 2023-24.11 India is the 6th largest exporter of textiles globally, with a 3.9% share in world textile exports. It contributes nearly 2% to the country’s GDP. The sector is set to grow to US$350 billion by 2030 further strengthening India’s position in the global market. This growth is expected to create 3.5 crore jobs.12 This opens up new opportunities not only for manufacturers but also for investors in technical textiles, powered by AI and IoT-driven innovation.

How the government of India is driving textiles forward

India’s central and state governments are actively working to propel the textile industry into a new era—one that is sustainable, technology-driven, and globally competitive. With the increasing demand for smart fabrics and eco-friendly textiles in both India and internationally, the government is supporting this transition with robust policies and targeted initiatives. Here are some of the prominent ones:

-

PLI Scheme in India: This Production Linked Incentive (PLI) scheme is giving a big boost to companies that manufacture technical textiles and man-made fibre. With an outlay of ₹10,683 crore,13 the scheme incentivizes businesses that invest in modern machinery, and advanced materials production. This helps establish global standards for Indian textile units, provides local employment opportunities, and encourages businesses to adopt greener and smarter practices.

-

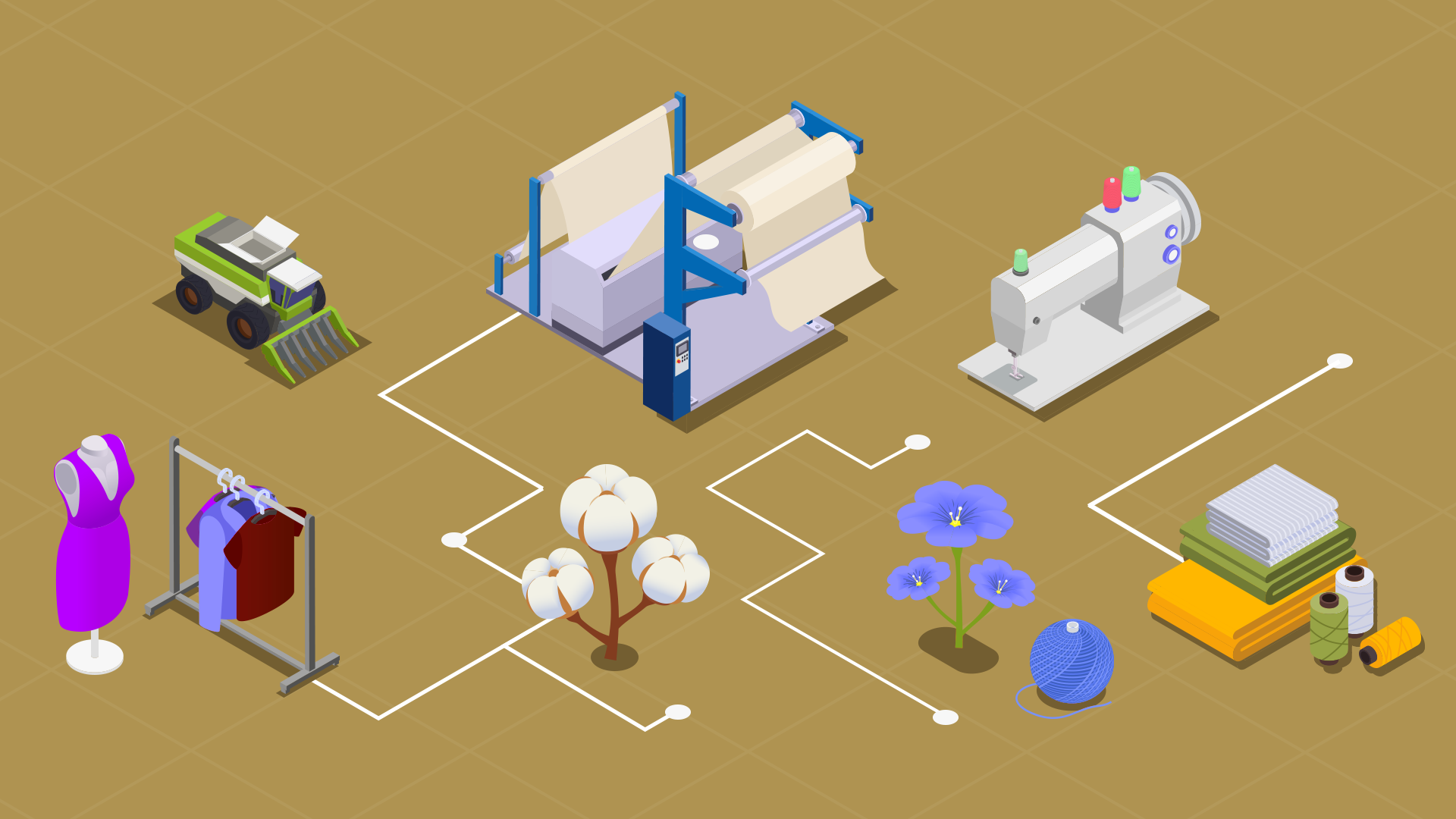

PM MITRA Textile Parks: The PM Mega Integrated Textile Region and Apparel (PM MITRA) is a new programme dedicated to developing seven large-scale textile parks across India. The government has allocated over ₹4,445 crore14 for the project, which will unite the entire textile manufacturing chain in one location. These parks will enable textile manufacturers to source fibre, create fabrics, and produce essential textiles all within the same textile park. Once completed, it is envisaged that each park will lead to an investment (both foreign and domestic) of about ₹10,000 crore, benefiting the local economy and textile ecosystem.15

The PM MITRA Textile Parks' mission is to reduce costs, improve manufacturing efficiency, and support a sustainable textile industry in India. The parks aim to establish a robust foundation for large-scale textile operations, backed by modern infrastructure and shared facilities that will ultimately enhance India’s position in the global textile market. -

National Technical Textile Mission: Launched in 2020, the National Technical Textile Mission has an outlay of over ₹1,480 crores.16 India’s technical textile offerings are broadly classified into 12 different categories: Agrotech, Oekotech, Buildtech, Meditech, Geotech, Clothtech, Mobiltech, Hometech, Sportstech, Indutech, Protech, Packtech. The mission aims to increase India’s share in the global technical textiles market and supports R&D, innovation, and startup collaborations in areas such as medical textiles, smart fabrics, geotextiles, and more. The mission is also funding over 74 textile research labs17 across the country to further invest in smart and functional fabrics.

Investing in green textiles and smart fabrics is crucial

India’s textile sector is entering an exciting new phase. Green Textiles and Smart Fabrics are receiving strong government support, and their rising global demand positions the country’s textile sector for a new era of rapid growth.

India’s robust manufacturing base positions this textile investment opportunity as one of the most promising in recent times. Momentum is building, and those who act early will be best positioned to reap the benefits. The growing ecosystem will eventually be supported by plug-and-play infrastructure established through programmes like PM MITRA, reduced compliance burdens through initiatives such as the National Manufacturing Mission,18 and expanding R&D capacity.

Green textiles and smart fabrics are not only future-ready but also aligned with global ESG goals and next-generation consumer trends. India offers cost advantages, skilled talent, and a stable policy environment—essential factors for long-term investments. For those looking to invest in the future of textiles, now is the time to act. You can begin by learning more at investindia.gov.in.