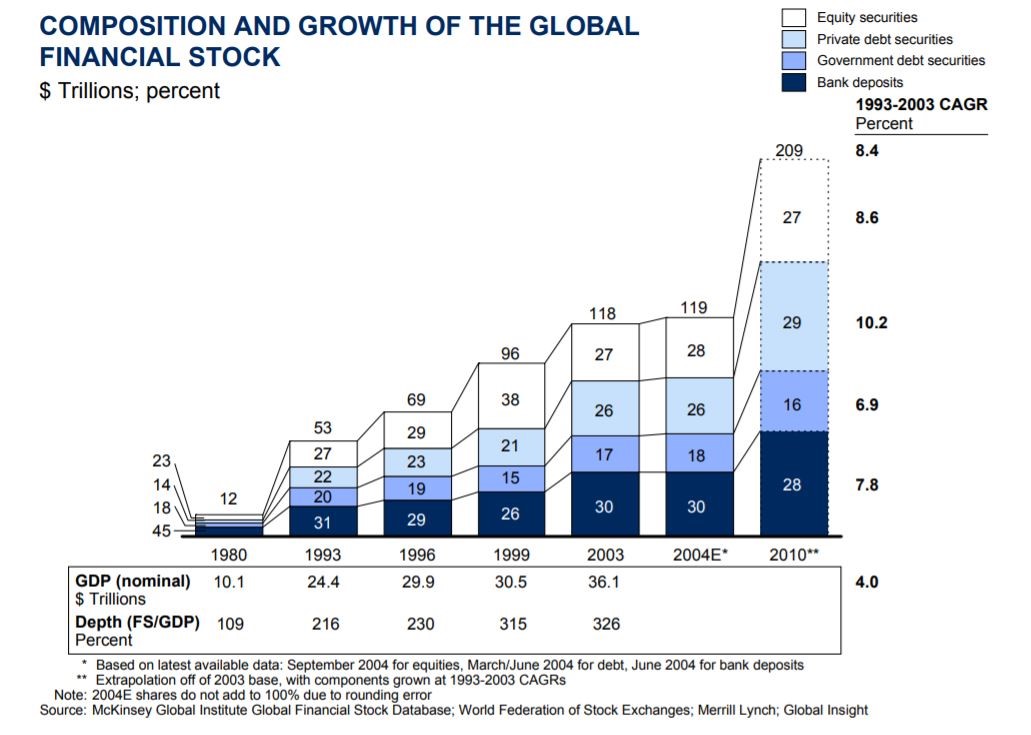

The capital markets have never been more dynamic than they are today. They are significantly shaping a country’s economic outlook while also forming a crucial backbone for it. In 2020 alone, the global equity market capitalization was valued at $ 105.8 trillion increasing 18.2% YoY and the global bond market’s outstanding value increased by 16.5% to $ 123.5 trillion1. Through the years, the global financial stock has consistently grown faster than world GDP, indicating that financial markets are becoming deeper and more liquid. And given the nature of today’s businesses, these numbers are only expected to grow and it becomes imperative for us to understand how these markets have been evolving.

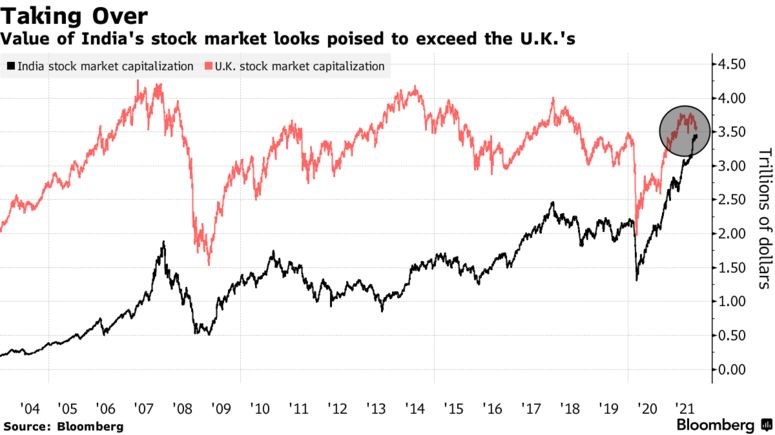

Talking about India, the capital markets of the country are on the rise too. They have experienced a significant structural transformation since India opened its economy to the world in the 1990s. Today it boasts two of the world’s largest stock exchanges, National Stock Exchange and Bombay Stock Exchange, and is considered one of the most preferred investment destinations for international capital, as evidenced by continued growth in foreign investments. In 2020-21 itself, India witnessed Foreign Portfolio Investment (FPI) inflows into the equity markets to the tune of $ 36.82 Bn (INR 2,74,034 crore) 2 , despite COVID-19. This reflects steadfast confidence of foreign investors in the fundamentals of the Indian economy. Alongside this, the range of capital raising options has also increased significantly in recent years as the established private equity and venture capital pools have grown, and as they are complemented by numerous alternatives. Further, India’s market capitalization has surged 37% this year to $ 3.46 trillion3 , according to an index compiled by Bloomberg, representing the combined value of companies with a primary listing there. That’s closing in on the U.K., which has seen an increase of about 9% to $ 3.59 trillion. The number of active investor accounts also rose by a record 10.4 million in 20204 , according to the data from the country’s two main depositories. Retail ownership in more than 1,500 companies listed on the National Stock Exchange of India jumped to 9 percent in the third quarter of 2020, the highest since March 2018.

Thus, we can see how our numbers have been growing, consistently and rapidly. But what are the reasons that have led to such a steady growth? Proximate causes are a series of policy initiatives taken by the government and systematic regulation introduced by the Securities and Exchange Board of India (SEBI). We have been able to create an investor-friendly environment not just for the domestic audience but also for foreign investors. Record-low interest rates, robust economic demand and a continued retail-investing boom are propelling stocks to record new highs. Strong liquidity coupled with positive macroeconomic cues is also likely to support domestic markets to continue their movements to record levels. Despite the pandemic, our markets have performed well making us the world’s sixth-biggest5 stock market, overtaking France for the first time in market capitalization.

That said, India is still far away from tapping the full potential that it can achieve. Its fixed-income and commodity markets are still shallow, with fewer incentives for market participants. Moreover, the exchange-traded fund (ETF) industry is still in its infancy when it comes to investor awareness and market structure. Of India’s 1.36 billion people, only about 3.7 percent invest in equities, compared with about 12.7 percent in China4, according to stock depository data on the number of investment accounts (and assuming one account per person). In the United States, by contrast, a poll found about 55 percent of the population owns stocks either individually or through a mutual fund. Thus, there still exists a huge opportunity to be tapped. And in order for Indian markets to achieve their full potential, stakeholders need to come together and take steps that can remove bottlenecks and ensure that the huge amount of savings available in the economy is harnessed sufficiently to power the growth engine, as the Indian economy grows toward achieving the $ 5 trillion target.

This blog has been authored by Mishika Nayyar and Vivek Sigchi Strategic Investment Research Unit.

- https://www.sifma.org/resources/research/fact-book/

- https://www.thehindu.com/business/fpi-inflows-cross-274-lakh-crore-in-2020-21/article34251428.ece

- https://www.bloomberg.com/news/articles/2021-10-11/roaring-india-stock-market-on-track-to-overtake-u-k-s-in-value

- https://www.business-standard.com/article/markets/millions-of-millennials-are-piling-into-india-s-stock-market-shows-data-121032500065_1.html

- https://www.livemint.com/market/stock-market-news/indian-stock-market-overtakes-france-becomes-sixth-biggest-11631730375607.html