Micro-Small and Medium Enterprises (MSMEs) have been playing an increasingly important role in India. They have emerged as a highly vibrant and dynamic sector of the Indian economy over the last few decades. A significant contribution has been made in economic and social development by fostering entrepreneurship and generating large employment opportunities at comparatively lower capital. As MSMEs absorb the surplus agricultural labor, they help reduce the problem of disguised unemployment in rural areas and are complementary to large industries as ancillary units and play a significant role in the whole eco-system of the secondary and tertiary sectors. As on 30th March 2022, Udyam Portal for MSME registration has recorded a total of 79,84,801 businesses in India of which nearly 95 per cent come under micro enterprises. The statistics reported by the Ministry of Micro, Small and Medium Enterprises 2021-22, revealed that out of 633.88 lakh estimated numbers of MSME, 324.88 lakh MSMEs (51.25 per cent) are in rural areas and 309 lakhs (48.75 per cent) in the urban areas of India.

An analysis of Udyam registration provides that as on 31st December 2021, 68 per cent of the MSMEs have been registered in the service sector while only 32 per cent account for manufacturing sector, out of which, maximum registrations have been done by the states of Maharashtra (nearly 14,00,000 registrations) followed by Gujarat, Uttar Pradesh and Madhya Pradesh. Another striking finding from the government data suggests that 28,684 micro enterprises and 3,679 small businesses registered on the Udyam portal have grown into small and medium-sized businesses respectively from inception till March 22, 2022. These progressive figures indicate progress towards a broad and deep commercial base in India. MSMEs are widening their reach across newer sectors of the economy such as defense and are producing a diverse range of products and services to meet demands of domestic as well as global markets. The Ministry of MSME runs numerous schemes and initiatives targeted at providing credit and financial assistance, skill development training, infrastructural development, marketing assistance, technological and quality upgradation and other services.

Here are some of the flagship schemes and initiatives for this sector:

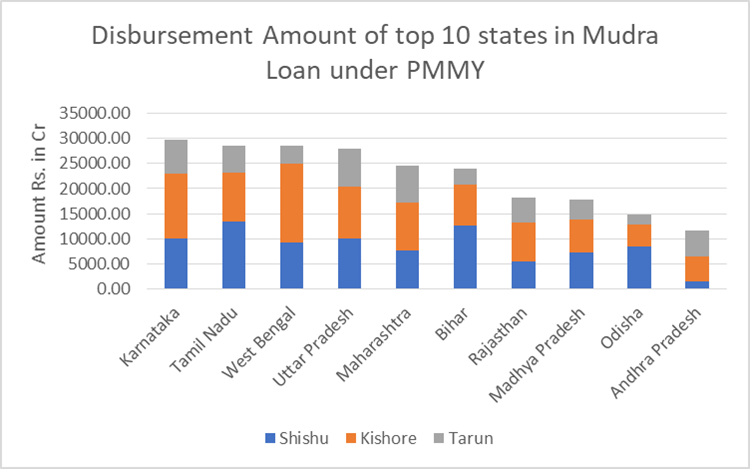

Mudra Loans: Pradhan Mantri MUDRA (Micro-Units Development and Refinance Agency) Yojana is a scheme launched in 2015 for providing loans up to INR 10 lakh to non-corporate, non-farm small/micro enterprises. Under the aegis of PMMY, MUDRA has created three products: Shishu Loans up to ₹50,000, Kishor Loans up to ₹5,00,000 and Tarun Loans up to ₹10,00,000. A total number of 4,86,39,491 PMMY loans have been sanctioned as on March 25th 2022 amounting to ₹307190.61 crore.

National Small Industry Corporation: It is a government agency that has been facilitating growth of small enterprises since 1955. The objective is to promote the MSME sector by providing integrated support services encompassing marketing, technology and finance. They offer two kinds of financial benefits: raw material assistance and marketing assistance. The former helps to avail economics of purchases via bulk purchasing and procure raw material with credit support for up to 180 days. During the financial year 2021-22, the value of raw material distributed is INR 1436 crore under sale purchases. NSIC has also implemented National SC-ST Hub (NSSH) since 2016 to provide professional support to the SC-ST entrepreneurs.

A Scheme for Promotion of Innovation, Rural Industries and Entrepreneurship (ASPIRE): It is a scheme for skills development and training that facilitates innovative business solutions and strengthens the competitiveness of MSME sector. It has also set up livelihood business incubators to provide skill training and incubation support to the incubatees through NSIC, KVIC, Coir Board and other institutions. The funds allocated for this scheme in 2021-22 was INR 15 crore of which 4.31 crore have been spent as on 31st December 2021.

Scheme of Fund for Regeneration of Traditional Industries (SFURTI): Scheme of Fund for Regeneration of Traditional Industries aims to organize traditional industries and artisans into clusters to make them competitive and provide support for long term sustainability, enhance marketability and improve skills.

Challenges in the MSME sector

Despite the MSME sector contributing significantly to the economy, it continues to face several challenges. Major challenges include physical infrastructure bottlenecks, absence of formalization, low credit access, inertia to technological adoption, lack of backward and forward linkages and the perennial problem of delayed payments. Even though the micro enterprises account for 95 per cent of the total MSME sector, their conversion into small and medium enterprise has been very low which suggests that they have not bee able to fully capture the benefits of economies of scale, adoption of technologies and investment into fixed assets. While the government continues to expand policy support and incentives for this major segment, MSMEs on their part also need to shed their inhibitions to adopt new technologies; accept e-payments, focus on product development, marketing strategy and inculcating competitive practices to gradually expand in size and scale and can become core pillars of the world economy.

With the continued implementation of reforms like the GST, (JAM Trinity), rising GeM procurement and a draft policy on MSMEs in the works, MSMEs in the country are poised for a sustained growth trajectory aided by the right government support as well as by the growing economic indicators of the country.

This article is co-authored by Vishakha Bhagwat and Devika Chawla).