Historical Context

Historically, NBFCs have been a vital cornerstone of the Indian financial ecosystem as important financial intermediaries channelizing savings and investments, especially for small-scale and retail sectors as well as underserved areas and unbanked sectors of the Indian economy.

Evolution

Over the years, NBFCs have evolved given the extensive changes in the regulatory framework for NBFCs in India which have moved from simplified regulations to stringent and extensive regulations as well as towards rationalisation per the currently revised NBFC regulatory framework. Given these high levels of regulation, NBFCs have also emerged as preferred options to meet credit needs since the low cost of operations has provided these NBFCs an edge over banks.

Financial Access and Supportive Government Schemes

Additionally, NBFCs have gradually become important mechanisms to fuel growth and entrepreneurship due to the launch of government-backed schemes including Pradhan Mantri Jan-Dhan Yojana which has contributed to a significant increase in the number of bank accounts.

These NBFCs have also been key in being able to mitigate and manage the spread of risks during times of financial duress and have increasingly become recognized as complementary services to banks.

NBFCs have become integral for all business services, including loans and credit facilities, retirement planning, money markets, underwriting and merger activities. As such these companies play an important role in providing credit to the unorganized sector and for small borrowers at local level. Additionally, hire purchase finance is also the largest activity of NBFCs and the rapid growth of NBFCs has gradually blurred the lines between banks and NBFCs although commercial banks have retained importance. These NBFCs facilitate long term investment and financing, which is challenging for banking sector, and the growth of NBFCs widens range of products available for individuals/institutions with resources to invest.

Opportunities for NBFCs

Ongoing stress in public sector banks (PSUs) because of increasing bad debt, lending in rural areas deterioration has provided NBFCs with the opportunity to increase presence. The success of these NBFCs vs. PSUs can be attributed to product lines, lower cost, wider and effective reach, strong risk management capabilities to check and control bad debts, and a better understanding of customer segments versus banks. NBFCs have witnessed success in the passenger and commercial vehicle finance segments as well as growing AUM in personal loan and housing finance sector. Additionally, improving macro-economic conditions, higher credit penetrations, consumption themes and disruptive digital trends have influenced NBFC credit growth. Stress in public sector units (PSUs), underlying credit demand, digital disruption for MSMEs and SMEs as well as increased consumption and distribution access and sectors where traditional banks do not lend are major reasons for the switch from traditional banks to NBFCs.

Present NBFC Classifications and Industry Structure

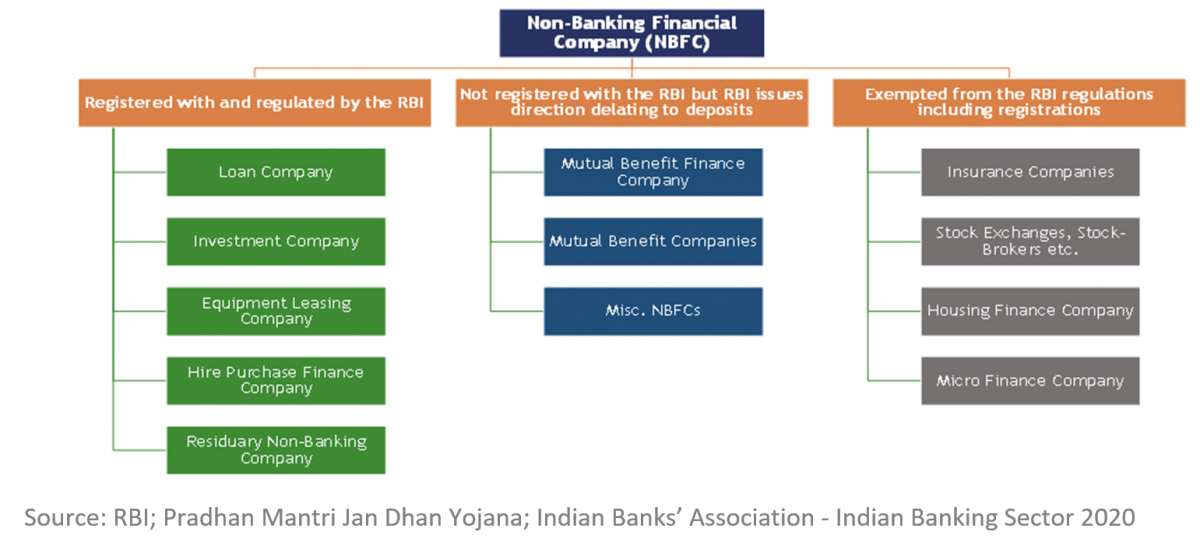

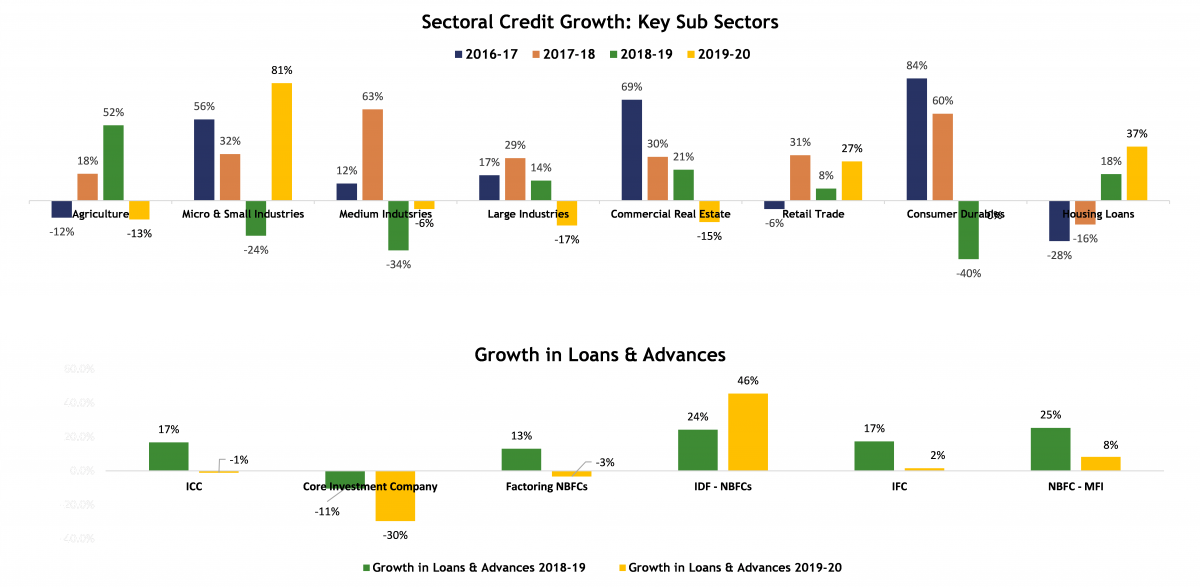

Most recently, as of Jan 22, 2021, there were 9,425 NBFCs registered with the RBI categorized as Asset Finance Companies, Loan Companies, Infrastructure Finance Companies (IFCs), Systematically Important Core Investment Company (NBFC – CIC – ND – SI), Infrastructure Debt Fund (NBFC – IDF) and Micro Finance Institutions (NBFC – MFIs). As a share of total assets in NBFC market, the Investment Credit Companies (ICC) have maintained the dominant share of total assets as have IFCs per the below over a 2019-2020 timeframe:

Most recently, as of Jan 22, 2021, there were 9,425 NBFCs registered with the RBI categorized as Asset Finance Companies, Loan Companies, Infrastructure Finance Companies (IFCs), Systematically Important Core Investment Company (NBFC – CIC – ND – SI), Infrastructure Debt Fund (NBFC – IDF) and Micro Finance Institutions (NBFC – MFIs). As a share of total assets in NBFC market, the Investment Credit Companies (ICC) have maintained the dominant share of total assets as have IFCs per the below over a 2019-2020 timeframe:

Where is the Growth?

Some of the key sectoral credit growth across key sub-sectors is for MFIs which have clocked 80% growth in 2019-20 and housing loans which have registered 37% growth in the same timeframe. Similarly, growth in loans and advances for NBFC-IDFs and NBFC-MFIs have registered strong growth at 46% and 8% respectively for 2019-20 period and similarly also demonstrated an upward growth trend in 2018-19.

NBFC Engines of Growth as Growth Drivers

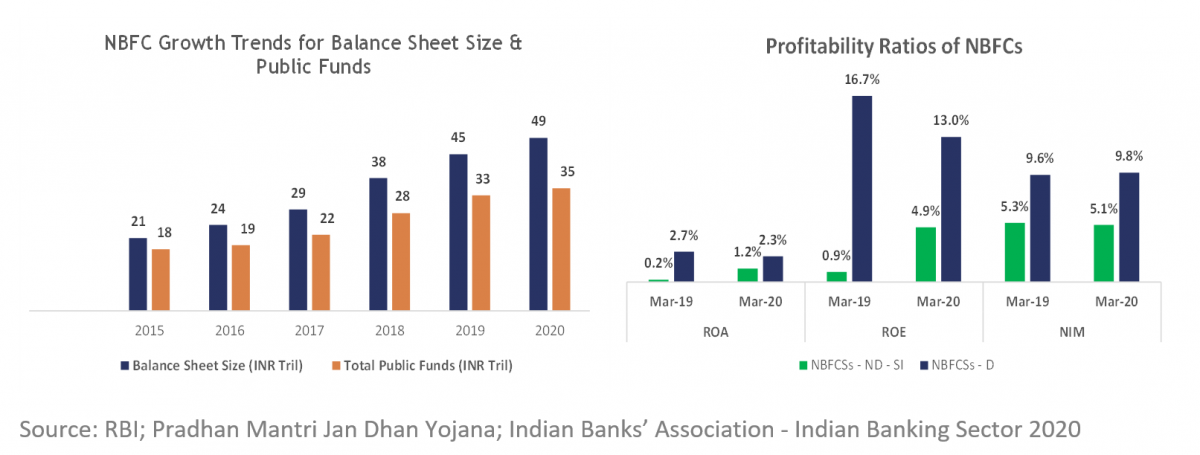

NBFCs have also been an integral cornerstone of key financing to MSMEs, and been driven by significant growth in rural, small scale and unbanked sectors. Structural catalysts include a large vibrant startup and entrepreneurial ecosystem which has created NBFC demand and government policy initiatives such as Pradhan Mantri Yojana and National Rural Financial plan further augmenting the industry. These include diversified financial needs of Indian economy driven by growth in lending, credit, and vehicle financing. As a result of these growth drivers, we see that NBFCs have seen bigger balance sheets & increasing public funds. Improved profitability ratios of NBFCs has been observed for NBFC-ND-SIs across metrics for ROA, ROE and NIMs with impressive returns Y-o-Y returns between 2019-2020. For NBFC-Ds the ROA has been relatively flat, ROE has declined while NIMs improved Y-o-Y for 2019-2020.